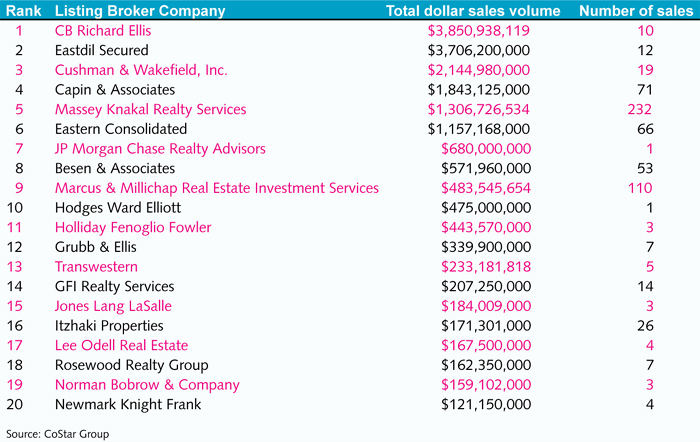

Full service commercial real estate firm CB Richard Ellis was the top investment sales brokerage in 2008 by dollar volume in New York City, according to data provided exclusively to The Real Deal by research firm CoStar Group (see below for full list).

The analysis shows that CBRE brokered 10 building sales totaling $3.8 billion in 2008, followed by Eastdil Secured with $3.7 billion from 12 building sales. Cushman & Wakefield ranked third with $2.1 billion from 19 sales.

In building sales volume, small building sales firm Massey Knakal Realty Services brokered 232 sales totaling $1.3 billion, Marcus & Millichap Real Estate Investment Services had 110 sales valued at $483 million and Capin & Associates had 71 sales totaling $1.8 billion, the data shows.

Lawrence Longua, a clinical associate professor at the Schack Institute of Real Estate at New York University, said he was not surprised which firms occupied the top three dollar volume spots. He said CBRE, Eastdil Secured and Cushman & Wakefield are the traditional sales leaders of high-end buildings.

“If I owned a trophy property in a gateway city, I would hire them,” he said.

He was not familiar with the firm that placed fourth in dollar volume and third in number of buildings sales, Capin & Associates. Among its 71 sales in 2008, the boutique-sized firm brokered several large deals, including three Upper East Side apartment buildings, bringing in $277 million.

In fact, although there are dozens of brokerages in the city handling investment sales, most have a narrow niche, reducing competition to a small group.

Longua said Manhattan-based Besen & Associates and Marcus & Millichap, a national firm based in California, concentrate on the outer boroughs and the Garment District, while Grubb & Ellis, another California-based firm, is still working its way into the New York market.

“CBRE is not competing with [mid-range broker] GFI [Realty Services]. As a seller of real estate, if I am going to find a sell-side agent I am not going to hire Cushman & Wakefield to sell a Long Island City industrial property,” he said.

Longua expected 2009 figures to be far lower as the investment market has cooled. Most brokerages have trimmed staff over the past several months.

The CoStar figures include both buy and sell sides of transactions for sales closed in 2008 as reported and confirmed by CoStar. Office sales are for properties 15,000 square feet or larger and exclude condominiums. Multi-family sales include four-unit apartments or more with sales prices of $500,000 and up, while all other property types are for 5,000 square feet or more and exclude condos.

Because both buy and sell sides were counted, some double counting may occur, CoStar warned.

A number of firms said their own records show higher numbers than CoStar’s. CBRE, for example, said it brokered $5.14 billion through 16 building sales, and Rosewood said it had $213 million with 13 properties sold. Several additional firms challenged the numbers, as well.