The beginnings of the current real estate downturn could be detected a year before this fall’s Lehman Brothers meltdown, a Citi Habitats data analysis of rental data shows.

The average rent for a Manhattan apartment in 2008 was $3,679, down from $3,724 the previous year, according to the report, released today, which measures Manhattan’s residential rental rate as per signed lease from 2004 to 2008.

As long as two years ago, the dizzying rent increases of 2005 and 2006 had already begun to slow, the data shows.

At the beginning of the boom, the report says, average Manhattan monthly rents increased only modestly. Between 2003 and 2004, the average rent for a studio grew 1.6 percent to $1,693, 2.5 percent to $2,380 for one-bedroom apartments and 5.5 percent for to $4,577 for three-bedrooms. Two-bedrooms fell 1 percent to $3,331.

By the next year, the boom had begun in earnest, with average rents in three of the four size categories shooting up roughly 7 percent.

Then, between 2005 and 2006, rents in every category spiked more than 9 percent. The average rent for a studio apartment in 2006 was $1,995, up 9.5 percent from $1,822 the year before. Rent for one- and two-bedrooms rose 9.1 percent, while three-bedrooms climbed a breathtaking 13 percent to an average of $5,534.

By 2007, the eye-popping increases had begun to slow, though it would be another year before the Wall Street meltdown barreled in Manhattan. The average studio in 2007 was $2,129, up 6.7 percent from the previous year. One-bedrooms climbed 4.9 percent, two-bedrooms 9.6 percent, and three-bedrooms 1.7 percent.

Though the full impact of the economic crisis wouldn’t be felt in New York City until later, economic trouble in other areas of the country had begun to affect the market.

“The economy started to shift,” said Gary Malin, the president of Citi Habitats. “You had those years of unbelievable appreciation — it got to a point where it couldn’t be sustained anymore.”

Not surprisingly, rents in nearly all categories fell between 2007 and 2008, data shows. The average rent for a studio in 2008 was $2,080, down 2.3 percent from the year before. Two-bedroom rents fell 2.8 percent to $4,151 and three-bedrooms fell by .7 percent. One-bedrooms rose .9 percent.

Actual rents are probably 5 to 10 percent lower, the report said, because the data did not take into consideration “net effective” rents impacted by popular concessions like a month of free rent.

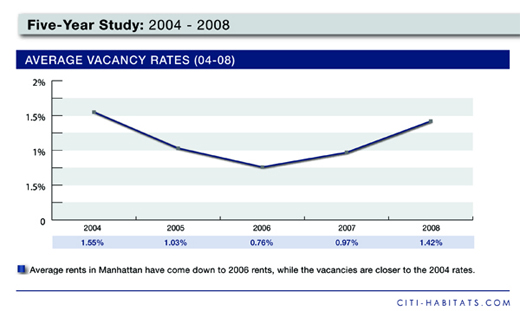

Average rental vacancy rates followed a similar pattern, dropping from 1.03 percent in 2005 to .76 percent in 2006, then growing to .97 percent in 2007. In 2008, the average vacancy rate jumped to1.42 percent.

Malin said Citi Habitats is starting to see signs of improvement in the market, with a slight increase in average rental rates in May 2009 from the previous month, the first time since May 2008 that has occurred. He added that the company has done more transactions in May of this year than in May 2008.

Still, that may be due to seasonality and the bevy of concessions currently available in the marketplace, he said, and does not necessarily mean the real estate downturn has passed.

“I still think it’s too early for anybody to say that we’re out of it,” he said. “Maybe the doomsday scenario has been inverted. Maybe when you come off that cliff and you’re on a normal cliff it doesn’t look so bad. But no one can definitively say the worst is behind us.”