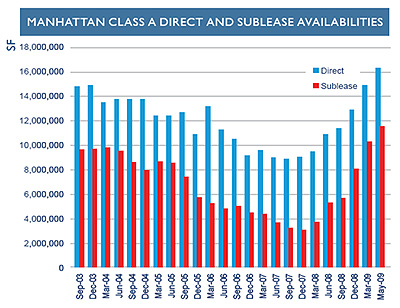

Source: Colliers ABR

While commercial leasing activity has picked up in the past few months, according to Colliers ABR’s Manhattan May office report (see report below), the city’s Class A vacancy rate increased and average rents fell last month.

The vacancy rate of Class A space in Manhattan reached 11.9 percent in May, up from 11.3 in April. Class B and Class C availability also increased last month, pushing the overall Manhattan vacancy rate to 13.1 percent, its highest level since reaching the same rate in December 1996. Meanwhile, the average asking rent for Class A space fell to $65.43 per square foot in May, down 4.9 percent from $68.83 a foot a month earlier.

In Midtown, which the report called “the eye of the storm,” Class A vacancy rose to 13.7 percent from 13 percent in April, thanks in part to two large spaces becoming available — 320,000 square feet of sublease space at 1271 Sixth Avenue and 411,000 square feet of sublease space at 277 Park Avenue. In the same period, Class A average asking rents in Midtown fell 5.7 percent to $69.23 per square foot. TRD

Colliers May Report