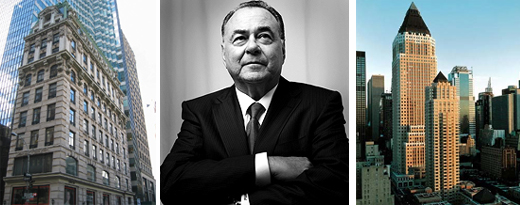

CB Richard Ellis’s chairman of global brokerage, Stephen Siegel, pointed to multiple bidders for Midtown office properties as evidence of strength returning to the investment sales market.

He said the 30 bids entered by last Friday’s deadline for 452 Fifth Avenue at 40th Street, an office tower owned by HSBC Bank, and the 16 or 18 bids at Worldwide Plaza, at 825 Eighth Avenue, marked the beginning of a coming wave of activity.

And although the deal at Worldwide Plaza recently collapsed, he said there were “five or six backup transactions there.”

Siegel said, “I think this is the beginning of what will be a very accelerated pace by the end of the year and the first half of 2010.”

Siegel was speaking yesterday on a real estate panel at the US Israel Executive Summit, organized by TheMarker, a major Israeli business magazine, held at the New York Public Library on Fifth Avenue. Other panelists included Stuart Koenig, global chief financial officer at Area Property Partners and Adrienne Albert, CEO of the Marketing Directors.

But Siegel put the onus on sellers to push up capitalization rates, used in the industry to value properties, which he said are too low and were therefore impeding sales.

“Savvy investors see prices are significantly below replacement costs, but what hasn’t happened yet is a realization by sellers [that] they have to be more aggressive with cap rates,” he said. “They are still fooling around with a 5 or 6 percent cap rate. Limited activity will remain, in my opinion, until they move up to the 8 or 9 percent range.”

Koenig said there was about $50 billion in private equity real estate opportunity funds waiting to buy distressed assets, and he was eyeing the estimated $1 trillion in mortgages coming due globally between 2010 and 2012. But he said it was still too early to buy up.

“We think the opportunities will be unprecedented,” he said.

He said Area applied for the federal government’s Public Private Investment Program for legacy assets.

“We are not counting on that, but we have lobbed in an application,” he said.

Left to right:

Left to right: