Source: PropertyShark.com

Source: PropertyShark.comThe number of new foreclosures in New York City decreased slightly during the second quarter of 2009 from the same period of last year, according to a second-quarter report released today by the real estate Web site PropertyShark.com.

New York City saw 892 new foreclosures in the second quarter, down 7 percent from 962 in the same quarter of 2008, according to the report, which tracked new foreclosures in four key metro areas. The number of foreclosures, however, rose 3 percent from the first quarter of this year.

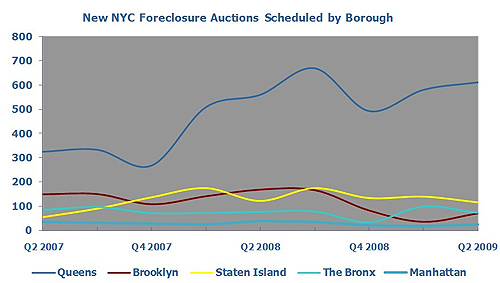

As in recent quarters, Queens led the city in foreclosures with 610 between April and June, up 9 percent from 492 in the same period last year. The borough also led the city in foreclosures per household, with one in every 1,270 homes scheduled for auction, or 0.079 percent.

Still, that’s far fewer than other areas measured by the report. In Los Angeles, for example, there were 13,654 foreclosures in the second quarter, with one in every 230 homes scheduled for auction. In Miami, there were 2,556 new foreclosures, and in Seattle, new foreclosures spiked 129 percent to 1,235 from the prior-year-quarter.

“Compared to the rest of the country, New York City is faring quite well,” said PropertyShark CEO Bill Saniford. That’s not because of a lack of subprime lending, which was quite common in areas like Jamaica, Queens, which had 51 foreclosures in the second quarter.

Instead, it’s because “we didn’t experience the overbuilding that they experienced in the other areas,” he said. “That is one of the biggest keys. We’re just in a more condensed area.”

Staten Island followed Queens with 115 foreclosures. The Bronx had 73, Brooklyn had 71 and Manhattan had only 23.

Such low foreclosure numbers don’t mean that Manhattan isn’t suffering economic distress, Saniford noted. He said banks are filing lis pendens for non-payment against homes in the area, but they are often sold before they go into foreclosure.