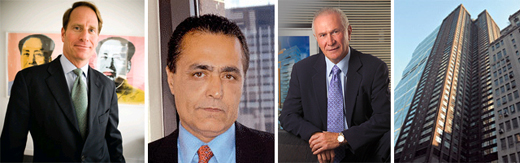

From left: Kent Swig, Yair Levy, Serge Hoyda and Sheffield57

From left: Kent Swig, Yair Levy, Serge Hoyda and Sheffield57Following two months of legal challenges and financial turmoil, Fortress Investment Group acquired the controversial Sheffield57 condominium for a mere $20 million during this morning’s foreclosure auction.

Fortress, a Manhattan-based hedge fund that previously acquired more than $100 million in defaulted Sheffield loans, made the lone bid at the auction, Giving It Total Control Over The 322 West 57th Street holding company. Out of the few dozen attendees, there were only two other registered bidders and neither made an offer for the building.

The sale, arranged by Eastdil Secured and held at the Midtown offices of Allen & Overy, the law firm representing Fortress, is considered a minor miracle for developer Kent Swig, who struck a June agreement to bring in the hedge fund as a white knight.

After buying the defaulted mortgage loan and senior mezzanine loan, Fortress advanced several million dollars to help pay off common charges and unpaid mechanic’s liens that Swig had accumulated.

Swig overcame a ferocious legal challenge from Yair Levy and Serge Hoyda, the majority investors at Sheffield57, who alleged that Swig misappropriated more than $50 million in construction funds.

The two partners and Gramercy Warehouse Funding, a junior mezzanine lender on the project, last month filed separate suits to prevent today’s auction. Motions to block the auction were denied by a State Supreme Court judge. The lawsuits alleged the auction was rigged to prevent other investors from acquiring the property. They also claimed that Swig arranged a back-end deal that would reward him for not pushing the project into bankruptcy.

“I did expect Fortress to prevail because the terms of the auction were such that it was very difficult for others to bid,” said Stephen Meister, attorney for Levy and Hoyda.

Officials from Fortress were not immediately available for comment, but attorneys for both entities have previously dismissed the Levy and Hoyda allegations as wild conspiracy theories from partners who don’t have any money to rescue the deal.

Swig attorney Y. David Scharf, said he hopes the deal will end the dispute with Levy and Hoyda.

“Pursuant to the cooperation agreement, the sponsor, which is comprised of Swig, Levy and Hoyda, has a profits participation if Fortress turns this project around and reaches certain financial milestones,” Scharf said. “Our client is pleased to have negotiated this arrangement with Fortress on behalf of the sponsor entity and hopes that now that the foreclosure process has been completed there can be a cessation of hostilities between the partners .”

Scharf added that if the litigation continues, Swig will “move quickly to dismiss the complaint” and is confident he will be vindicated.

The foreclosure sale effectively wipes out Levy and Hoyda’s interest in Sheffield57, a former 845-unit rental building that they bought with Swig for $418 million in 2005, one of the biggest acquisitions of a residential tower in U.S. history. Swig will no longer hold an equity stake in the deal. However, his true interest is a matter of dispute.

But, Fortress, in court papers filed in the Levy and Hoyda suit, disclosed that the three Sheffield57 investment partners will be eligible for about $7 million of backend revenue. The partners will be eligible for up to 49 percent of future revenues, based on a complicated formula.

Meanwhile, Rob Braverman, attorney for hundreds of condominium owners at the building, is scheduled to meet with Fortress this afternoon, to move quickly on a plan to relaunch construction and resume sales at the building. Attorney General Andrew Cuomo halted all sales at Sheffield57 because Swig failed to provide an updated amendment to the condominium offering plan, as well as audited financial statements.

“We’re looking forward to working with the new sponsor and getting the project back on track,” said Braverman.

Braverman says he was told that Swig will have no direct role in the project any longer, and that Fortress is looking for a new management company. Rose Associates, the former owner of Sheffield57, has been retained by Fortress as a consultant.