Developers such as Lloyd Goldman, the Chetrit family and commercial broker Robert Knakal have recently opened their wallets as the citywide race for comptroller heats up, according to the most recent campaign finance documents filed last week.

Brooklyn City Council member David Yassky took in the largest amount of contributions from real estate interests among the four major candidates for city comptroller, an analysis of the most recent reports from the city’s Campaign Finance Board, covering July 12 to August 10, by The Real Deal shows.

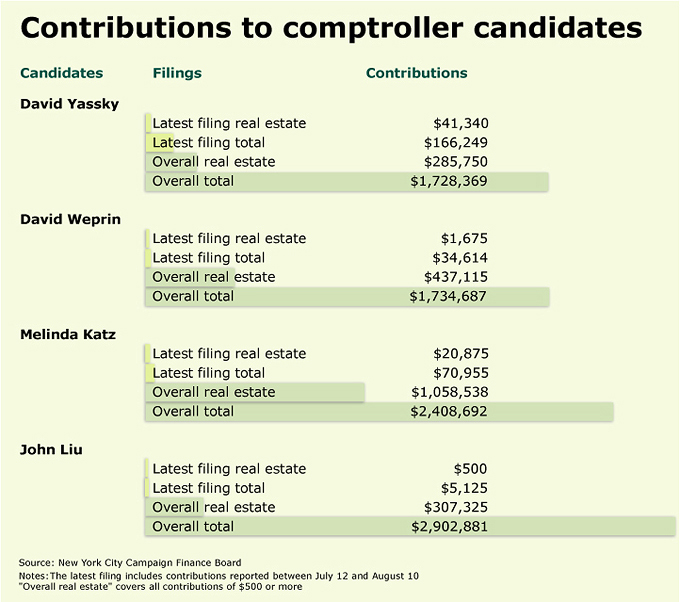

But Yassky remains far behind Queens Council members Melinda Katz and John Liu in overall contributions, and is about tied with David Weprin, another Queens Council member.

The primary election is September 15, with a runoff contest September 29 in the event that no candidate wins more than 40 percent.

A July Quinnipiac poll shows the race is a toss up, with Liu leading with 17 percent, trailed by Katz with 10 percent, Yassky with 8 percent and Weprin with 5 percent.

The comptroller provides audits for the city as well as oversees the city’s pension funds, which invest in real estate assets. The race is hitting a phase when candidates begin to air expensive television and radio commercials.

Nearly a quarter of Yassky’s contributions in the most recent filing period were from real estate interests, comprising some $41,340 from a total of $166,249 contributions received in the month ending August 10. He led the comptroller candidates in overall donations in the period, but was fourth among the four candidates since fundraising began in 2006, raising $1.7 million. Of that, at least $285,000 was real estate-related, the analysis shows.

Yassky’s district includes Williamsburg and Greenpoint, which have been heavily developed with new condominiums in recent years.

Donations over the month include $4,950 from Lloyd Goldman, head of BLDG Management; $2,450 from Yitzchak Tessler, CEO of Tessler Developments and $1,000 from David Greenbaum, president of the New York office of Vornado Realty Trust.

Katz, chair of the powerful land use committee, took in the second greatest amount of real estate funds this period, but has raised the most from the industry totaling at least $1 million since fundraising began in 2006. Her total contributions come to $2.4 million.

Katz raised about $20,875 from real estate interests over the past month, about 30 percent of the total of $70,955 raised in the filing period.

Her top real estate contributors from the recent filing include Judy Kalikow, married to developer Peter Kalikow, who gave the maximum $4,950, and three members of the Chetrit family that gave a combined $7,500.

The Kalikow family has given a combined $32,200 to Katz since the campaign began, records show.

Knakal, chairman of commercial brokerage Massey Knakal Realty Services, contributed $175 to Katz in the last filing period. But in prior periods he favored Weprin, giving him a total of $1,750.

The other major comptroller candidates, Weprin and Liu, raised far less than Yassky and Katz in the recent period. Weprin raised about $1,675 from people with real estate-related interests out of a total $34,614 he received over the past month. Weprin has raised $1.7 million total and about $437,000 is from the real estate industry since fundraising began.

Liu received about $500 from real estate interests from about $5,125 raised in the most recent period.

“I have not targeted any people or occupation. Basically we want support from everybody, and that includes some people with real estate interests,” Liu said.

He has raised the most, some $2.9 million, but the lowest ratio from real estate, taking in approximately $307,000. In addition, he has slowed in taking contributions because he has on hand more than he can spend as set by campaign finance limits.