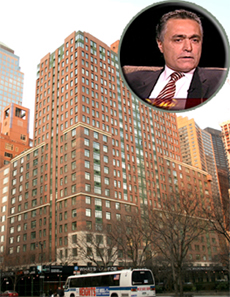

Yair Levy, 225 Rector Square

Anglo Irish Bank filed a motion in New York State Supreme Court earlier this month to complete foreclosure proceedings against Rector Square developer Yair Levy and place the troubled Battery Park condominium conversion on the auction block for sale to a new investor.

Anglo Irish originally filed suit in February alleging that Levy defaulted on a $165 million mortgage loan to convert the 304-unit rental building at 225 Rector Place, and failed to pay millions of dollars in contractor’s fees, common charges and PILOT payments to the Battery Park City Authority, which controls the ground lease under most, if not all, Battery Park buildings.

Levy later tried to preempt the foreclosure suit by filing a countersuit in Nassau County, where he resides, alleging that Anglo Irish forced his property into default by holding up construction dollars. That case was later consolidated into the foreclosure suit filed by Anglo Irish.

Anglo Irish was issued subpoenas in recent months under a state and local investigation of the Rector Square reserve fund, sources say, which was depleted prior to the foreclosure proceeding. Officials alleged that funds in the Rector Square reserve fund and operating funds were not properly accounted for, and sources say that Manhattan District Attorney Robert Morgenthau was asked to step into the probe. A spokesperson for Morgenthau’s office told The Real Deal recently that it doesn’t comment on investigations.

Veteran trust attorney Michael Miller was later named receiver at Rector Square, where he named Related Companies as the new managing agent of the building. Over the past three months, Miller has completed construction of some of the building’s common areas and Related has begun to rent out about 40 non-renovated apartments in the building.

At the end of July, the state attorney general approved a new amendment to the Rector Square condo offering plan.

The amendment notes that buyers who purchased their apartments prior to the amendment have now been granted the right of rescission, or a full refund of their deposits. Marc Held, the attorney for the 46 buyers at Rector Square who closed their contracts and moved in, has sent notices to Dewey & LeBoeuf, the law firm that placed deposits into escrow accounts, to allow his clients to get full refunds on their purchases.

According to the 10th Amendment, the building had 233 unsold units as of February 2009. In addition to the 46 buyers who moved in, there are dozens of affordable housing tenants at the building who previously lived there before the conversion. Levy also sold about 15 condo units to an Italian university, which uses them to house students when they come to New York for study abroad.

Rector Square was one of the first, and largest, judicial foreclosures of a functioning condo building in the history of New York. A number of condos have gone into judicial foreclosure since, including the Jasper, at 114 East 32nd Street; however, that building had 43 of 80 units under contract, but no existing residents.

Yair Levy’s other major condo conversion, Sheffield57, went into a non-judicial foreclosure in early August, after managing partner Kent Swig defaulted on more than $100 million in mortgage and mezzanine loans. Levy’s interest in Sheffield57 got wiped out after Fortress Investment Group bought Sheffield57 at auction in early August.

Attorneys for Anglo Irish Bank were not immediately available for comment. David Segal, attorney for Yair Levy, was not immediately available for comment.