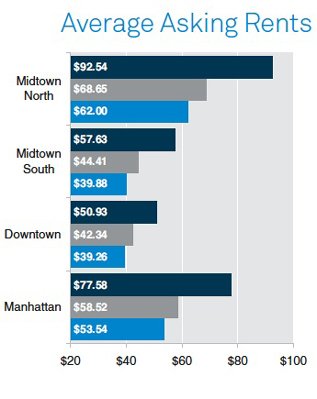

Dark blue is third-quarter 2008; grey is second-quarter 2009, light blue is third-quarter 2009 (Source: FirstService Williams)

Manhattan office leasing market indicators were mixed in the third quarter of 2009, showing a continued weakening of asking rents but a flattening of availability rates, according to a report released today by commercial services firm FirstService Williams. (See full report below.)

Asking rents in Manhattan fell by 8.5 percent in the third quarter to $53.54 per square foot, from $58.52 per square foot in the prior quarter, the report says.

The decline was not as steep as in the second quarter, which saw a drop of 10 percent from the previous quarter.

Asking rents fell by 32.6 percent in the third quarter from their peak in the second quarter of 2008, the data shows.

Availability rates in Manhattan stayed steady at 13.4 percent, after rising in the second quarter from 12 percent in the first quarter.

Midtown saw the largest price decline in asking rents, falling by $6.65 per square foot to $62 per foot, the data shows.

Mark Jaccom, CEO of FirstService Williams, said the firming up of the availability rate so soon after the apparent end of the national recession in mid-2009 was surprising, “especially relative to what happened during the last down cycle in the economy, which occurred in 2001,” Jaccom said in the report.

Leasing volume also rose in the third quarter, to 5.5 million square feet, from 3.1 million in the second quarter, the report shows.