While CBRE data showed average leasing velocity for the third quarter was 3 percent above a five-year monthly average, Cushman figures showed the quarter was 35 percent below its quarterly average.

CB Richard Ellis executives gave a more positive view of Manhattan office leasing than uptown rival Cushman & Wakefield, during each firm’s third-quarter market breakfast briefing this week.

Paul Amrich, executive vice president at CBRE, highlighted a decrease in tenant improvement contributions and a $0.06 decline in asking rents in Midtown, the smallest decline all year.

“Historically when you see concessions start to level or go back that is a sign the market is starting to find the bottom,” he said at the firm’s Midtown office today. “The next move would be that rents find the bottom. The hope is that some time in 2010 we will see some slight growth.”

In contrast, the day before, Cushman & Wakefield COO Joseph Harbert said despite an uptick in third-quarter leasing activity, 2009 would end up at about 16 million square feet leased, or about 10 million square feet below a “healthy” year.

“Unfortunately, that would make us the weakest leasing year in about 13 years,” Harbert said. “There is no way to sugarcoat it.”

For September, CB Richard Ellis reported a 0.1 point increase in the overall Manhattan vacancy rate, to 9.3 percent from a month earlier. At the same time, leasing activity declined month-over-month by 18 percent to 1.46 million square feet, and average asking rents fell by $0.50 to $50.78, the firm reported.

Citing data for the third quarter covering July through September, Cushman & Wakefield reported a 0.6 percent increase in the vacancy rate from the second quarter, to 11.1 percent. Leasing activity for the quarter was 4.9 million square feet, up 50 percent from the second quarter, while average asking rents fell by $3.15 per square foot to $57.08.

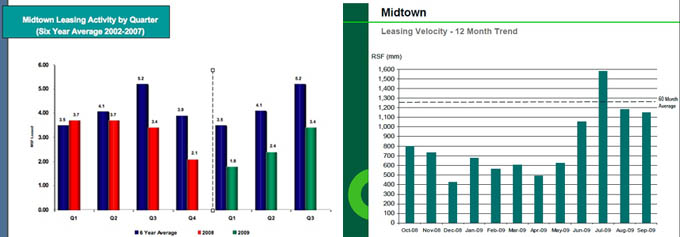

While the CBRE data on leasing velocity indicates an improving market, comparable data from Cushman shows continued weakness.

CBRE figures show September was the fourth consecutive month with leasing above 1 million square feet and the average leasing velocity for each month in the third quarter was 3 percent above a five-year monthly average.

But Cushman statistics tell a different story, indicating that third-quarter leasing was 35 percent behind its quarterly average.

While there was in increase in the third quarter over the second quarter, a part could be accounted for by a seasonal bump. The third quarter on average sees 26 percent more square feet leased than the second quarter.