While commercial real estate experts predict a rise in distressed securitized loans for New York City over the next year, new data shows the number of assets added to the tally last month actually fell.

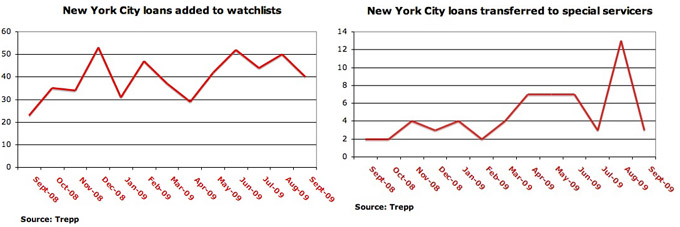

The quantity of loans transferred to special servicers dropped sharply last month, and those placed on servicer watchlists declined slightly, new data provided by financial tracking firm Trepp to The Real Deal shows.

Only three New York City loans were transferred to a special servicer in September, down from 13 the month before, the figures indicate.

At the same time, the volume of assets placed on a servicer’s watchlist fell slightly to 40 from 50 the month before.

Loans are transferred to special servicing typically after a default, while loans are placed on a watchlist when the servicer is concerned with the loan, but it is generally not in default, according to Trepp.

Experts cautioned that a one-month decline in new, troubled loans should not be interpreted as a turnaround in the environment for loans pooled into commercial mortgage-backed securities, which are widely expected to further weaken.

“It is easy to make too much of one month. You need to look at a longer period,” Matthew Anderson, partner at California-based real estate analysis firm Foresight Analytics, said. “I don’t think the sense in the market is that we have turned the corner on the real estate fundamentals,” he said.

Frank Innaurato, managing director at Pennsylvania-based financial research firm Realpoint, said his firm is predicting defaulting loans will increase into 2010.

The largest loan transferred to special servicing was for $29 million at Vornado Realty Trust’s 50 West 57th Street, which was listed as a performing asset that had matured but had not yet been refinanced, Trepp data said.

A second note was for $11 million, borrowed against 290 Madison Avenue, a six-story office building between 40th and 41st streets, owned by APF Properties that is 60 days delinquent, the information shows.

APF Properties bought the 37,500-square-foot building from SL Green Realty in July 2006 for $19 million, and later that year took out $11 million in loans that were later securitized.

News reports from 2006 say the building was fully occupied at the time of the purchase, but today it is 71 percent vacant, data from research firm CoStar Group shows.

A call to APF Properties was not immediately returned.

The third note transferred to a special servicer was a $9.5 million loan on the Timekeeper Building at 307 East 53rd Street, which is 60 days delinquent, Trepp data shows.

The largest loans placed for the first time under a watchlist include a $212 million loan on 1515 Broadway, owned by SL Green Realty; and a $203 million loan on the hotel Park Central New York at 870 Seventh Avenue, Trepp information indicates.

The third highest is a $187 million loan on Murray Hill Properties’ One Park Avenue, the data shows. All those loans were listed as current.