From left: Prudential Douglas Elliman brokers Leonard Steinberg and Tamir Shemesh

While the question over whether to extend and expand the first-time homebuyer tax credit rages on, New York City brokers are offering mixed reviews of the senate proposal. The senate won’t vote on the proposal until next week — at the earliest — but many industry experts in the Big Apple have already made up their minds.

As far as the naysayers are concerned, the current tax credit program, set to expire at the end of November, has done little to help the housing market in the city and they doubt an expanded program could change that.

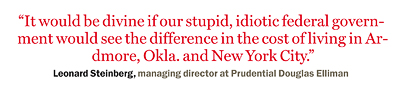

“It would be divine if our stupid, idiotic federal government would see the difference in the cost of living in Ardmore, Okla. and New York City,” Leonard Steinberg, a managing director at Prudential Douglas Elliman and a broker specializing in luxury listings, said.

While Steinberg believes the right stimulus program could help the Manhattan market he, like several other brokers who spoke to The Real Deal, said that even the proposed expansion of the homebuyer tax incentive is too restrictive in its income limits to have a significant effect on Manhattan home buying.

“It’s not going to have any effect on the Manhattan market unless they raise the income limit [a lot],” Steinberg said. He suggested that a program with no income cap might even work. At a bare minimum, Steinberg said that the homebuyer tax credit needs to take into account the disparity between different states’ financials.

“How much do New Yorkers contribute to the federal coffers and how much do we get back in return? Less than half of what New Mexico does,” Steinberg said. “If you have paid a ton of taxes in the past 10 years… and pay more to the federal government than it delivers back to you, I think you should be entitled to a bigger break.”

The new program would increase the income cap, letting individuals making $125,000 a year and married couples making $225,000 or less qualify. Under the current program, which will expire Nov. 30, that number has been significantly lower, with individual buyers earning no more than $75,000 annually and married couples earning a combined $150,000.

The new program would also extend the $8,000 first-time homebuyer credit through April 30, 2010, and would add a $6,500 tax credit for so-called “move-up” buyers — those who have lived in their current home for at least five years.

That has left many Manhattan buyers, who typically earn more than the proposed income cap, out of the loop, according to Jonathan Miller, president of appraisal firm Miller Samuel. Miller said that the average Manhattan buyer simply doesn’t meet the criteria. Even if they do qualify, Miller says that with median home prices in Manhattan hovering around $800,000, the $8,000 credit makes very little difference to the average homebuyer in Manhattan.

Better than the proposed changes, Miller said that a tax credit of around $15,000 would create a much more noticeable difference in the Manhattan market.

“It didn’t nearly have the effect [in Manhattan as] it did on lower cost markets,” Miller said. “The general feedback I got in, say, suburban Chicago was that three-quarters of the sales were driven [by the] credit.”

Kathy Braddock, co-founder of Charles Rutenberg Realty in New York, said extending and expanding the program would be a good thing.

“Any time that we can give somebody a value proposition, they are intrigued,” Braddock said. She believes that the tax credit, even if it hasn’t made much of a difference on paper in Manhattan, has had a psychological effect on the buying market in the borough.

She argued that, like the cash for clunkers program, the tax credit creates buzz and makes hesitant buyers want to get into the sales market.

Even so, Noah Rosenblatt, founder and publisher of Urban Digs brokerage and research Web site, said that any psychological effect from the extended tax credit won’t have any long-term effect. As far as he’s concerned, extending the program at all is a waste of time and resources.

Still, some brokers said that they have reaped the benefits of the homebuyer tax credit program so an extension and expansion could only help business.

Tamir Shemesh, a managing director at Elliman, said that he’s closed three deals in Manhattan in the last month thanks to the first-time homebuyer tax credit. While all three, one at 416 East 83rd Street and two at 244 Madison Avenue on the corner of 36th Street, were under $500,000, Shemesh said that the expanded and extended program could bring in more sales at prices closer to $700,000.

John Falco, president and co-founder of Maspeth-based Falco & Isak Realty Services and a long-time Queens broker, said due to the credit he’s seen more zeal in buyers and an augmented program would just be a good thing.

While sources were divided over how much of an impact an expanded program could have, the industry experts all agreed that the fundamentals of the economy need to improve in order for the tax credit to have a significant impact. Both tight credit and rising unemployment were cited as detrimental factors to the housing market, specifically in new developments.

Falco noted that while the tax credit probably serves Queens more than other boroughs in the city, the borough still has a high rate of unemployment. Until those figures turn around, Falco said that the Queens homebuying market won’t fully stabilize, tax credit or not.

Braddock said that loosening credit from lenders will have more of an effect on new developments in the pipeline than an extended tax credit would. While a tax credit might create more buyer demand, Braddock said, banks are still gun shy about lending to new projects.

Industry experts agreed that, unlike buyers, lenders are less likely to have their sentiment manipulated by federal initiatives.

Miller said that long-lasting change will have more to do with stabilization in the market as a whole, not just a subsidy.

The tax credit “has changed the tone… it gave people the sense that there were efforts being made on the federal level,” Miller said. “But I’m not so sure if in the long run it’s a productive thing.”