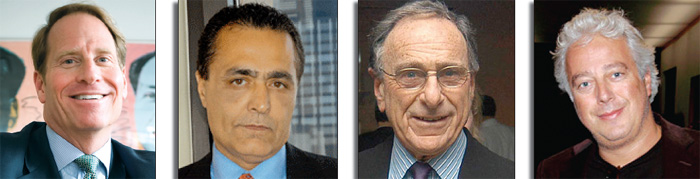

From left to right: Kent Swig, Yair Levy, Harry Macklowe and Aby Rosen could be personally liable to lenders.

From the November issue: Contrary to popular belief, commercial lenders did not throw out all of their standards in the recent cycle of easy credit.

When developer Aby Rosen structured his $133 million loan for the

acquisition and development of the Shangri-La hotel at 614 Lexington

Avenue in April 2007, the mortgage document included a personal

guaranty to cover losses in the event of a default. Similarly, when Kent Swig negotiated $49 million in loans with

Lehman Brothers Holdings to develop a hotel and condo project at 45

Broad Street in the Financial District in 2006 and 2007, the bank

demanded a similar guaranty in the mortgage documents.

And other big-time borrowers such as developer Yair Levy and

investor Steven Elghanayan have made the same types of commitments to

convince banks to make loans on their projects.