From the December issue: If the last 12 months have served as a humbling recalibration of the entire U.S. economy, then there is perhaps no urban office district more representative of America’s fall from opulence than the commercial stretch along Park Avenue in Midtown. For decades, it was the province of the financial titans, including JPMorgan, Lehman Brothers and UBS, whose paychecks and egos were matched, in part, by Park Avenue’s astronomical asking rents in its premier buildings. But now, much like its former white-gloved denizens, Park Avenue is an empty shell of its former self. The Park Avenue submarket — which runs from Grand Central to 59th Street — has fallen harder and faster than any other Manhattan submarket over the past 12 months. According to Cushman & Wakefield, from October 2008 to October 2009, average asking rents dropped 34.7 percent, from $108.57 per square foot to $70.85 per square foot. By comparison, overall asking rents in Manhattan fell 22 percent during the same period.

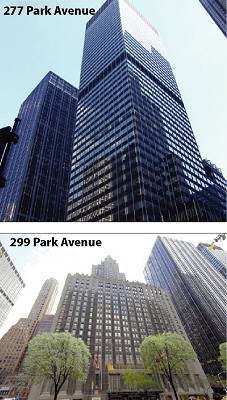

Park Avenue gets pounded

<i>Former house of financial giants sees bigger rent drop than any other submarket</i>