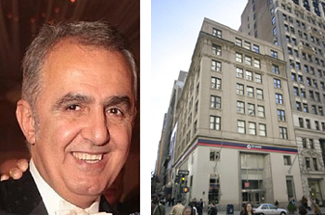

Dario Zar, president at Zar Property NY, and 349 Fifth Avenue (Building photo source: PropertyShark)

The Midtown-based real estate firm Zar Property NY bought the JPMorgan Chase building at 349 Fifth Avenue at 34th Street across from the Empire State Building, for just under $20 million, David Zar, a vice president at Zar Property NY, told The Real Deal today.

The purchase closed Dec. 15, Zar said, but he did not immediately provide an exact sale price. The sale has not yet appeared on the city’s public property Web site Acris.

The price of about $300 per square foot for the 64,000-square-foot building was far higher than the bank received for a 1.1 million-square-foot property it is selling Downtown. JPMorgan Chase is in contract to sell 4 New York Plaza at Water Street for $108 million, or about $99 per square foot. The building was part of a nearly two-dozen-building portfolio that was put on the market earlier this year.

The Fifth Avenue building merited the $300 price per foot, he said, because of the location across from the Empire State Building and the quality of the space, which was turned over fully furnished.

The top 43,000 square feet of the eight-story vacant building housed the consulting and executive offices for a lending division of the bank, Zar said.

In addition, the bank signed a lease-back deal for the retail space occupying the ground floor, basement and mezzanine, he said.

Leasing broker Dirk Hrobsky, managing director at commercial firm UGL Equis, said comparable space in that area could fetch rents of under $40 per square foot. He was not involved with the sale. Zar declined to give a proposed asking rent.

A broker familiar with the Fifth Avenue deal, who asked not to be identified, said there were multiple bidders for the asset, and Zar Property won because it was “the most serious buyer.” Another broker said a client offered about $16 million for the building, but lost out. A report in the trade weekly Real Estate Investment & Finance from November said the bank was seeking at least $13 million for the property.

John Kenyon, a senior vice president at Houlihan Lokey, which represented Chase, declined to comment, as did a spokesperson for JPMorgan Chase.

Family-owned Zar Property, led by president Dario Zar, David’s uncle, has bought other properties since the economy weakened, including a Soho building for $12.65 million in January. It owns about four million square feet of commercial and residential property nationwide, David Zar said.