Manhattan rents remained relatively flat month-over-month, according to TDG/The Real Estate Group of NY’s December Manhattan residential rental market report released today (see full report below).

Doorman units saw a 1.19 percent drop in price in December, according to the report, which covers Nov. 15 to Dec. 15, while non-doorman units actually saw a price increase of .87 percent.

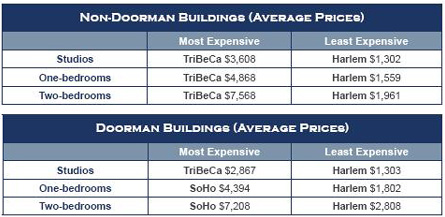

Meanwhile, year-over-year, doorman apartments were hit the hardest, price-wise, the report says, while non-doorman units saw more moderate price declines. Apartment rental prices for doorman buildings dropped 5.79 percent compared to 2008 and non-doorman units declined just 1.74 percent.

The flat month-over-month activity bucks the downward seasonal trend typically seen in the winter rental market, the report says.

Even so, non-doorman units saw a 6.08 percent rise in vacancies from last month, something that could precipitate a price decline in that type of unit, said Andrew Barrocas, COO of TDG/TREGNY.

But doorman units only saw vacancies increase by 0.43 percent.

“Anytime you have a spike in vacancies… what would be normal would be to see a price decline or additional incentives [added],” Barrocas said. He said that doorman buildings have done a good job of cutting prices, providing renter incentives and adding perceived value to the units, something that has helped them maintain a stable vacancy rate. He expects non-doorman buildings may angle to do the same in the coming months.

The report is based on more than 10,000 available listings culled from a combination of databases, located below 155th Street and priced under $10,000 per month.

Of all 15 Manhattan neighborhoods the report examines, non-doorman studios on the Lower East Side and doorman studios in Battery Park City saw the biggest price increases from November, with rents increasing 13.81 percent and 13.62 percent, respectively. Non-doorman one-bedrooms in Gramercy Park and doorman one-bedrooms in the Financial District saw the biggest drops month-over-month, declining 9.17 percent and 10.58 percent, respectively.