New leasing activity in Midtown jumped by 34 percent in December from

the prior month, ending the year with an annual volume just shy of the

2008 level, yet despite the strong leasing levels, average asking

rents continued to fall in all Manhattan markets, figures released

yesterday from commercial services firm CB Richard Ellis show.

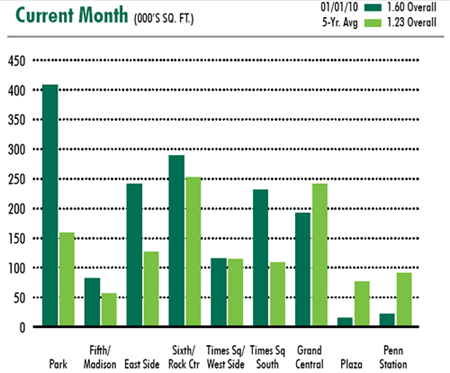

The volume of new leasing in Midtown last month was 1.6 million square

feet, up from the prior month’s level of 1.19 million square feet, and

was ahead of the five-year monthly average of 1.23 million square

feet. Average asking rents fell by $0.04 per square foot to $56.02 per

foot, while in the Park Avenue submarket, average asking rents fell

sharply by $2.49 per foot to $60.93 per foot, the report says.

For the full year, leasing activity in Midtown was 11.63 million

square feet, off slightly from the 2008 totals of 11.87 million square

feet.

“Renewals and expansions dominated December’s roster of top deals,

while robust new leasing activity across the market fueled the month’s

overall leasing tally,” the Midtown analysis indicates. The other reports

covering Midtown South and Downtown were also released yesterday.

In Midtown South, leasing activity was 320,000 square feet in

December, up from 270,000 square feet in November, while average

asking rents fell by $0.25 per foot to $40.53 per square foot, the

figures show.

In the Downtown market, leasing activity declined in December by 12

percent to 280,000 square feet from 320,000 square feet in November,

and average asking rents fell by $0.51 per foot to $38.12 per square

foot, the CBRE statistics reveal. TRD