The Manhattan-based real estate investment trust SL Green Realty lost $5 million in the fourth quarter, compared to a gain of $76 million in the same period last year, the company said today.

Manhattan’s largest office landlord reported revenues of $246 million in the fourth quarter, the company’s fourth quarter figures published this afternoon show, a drop of 8 percent from revenues of $269 million in the same period last year.

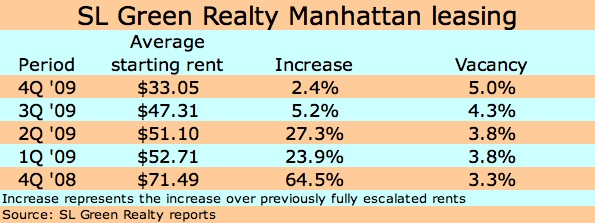

In addition, average starting rents in Manhattan for the REIT dropped by nearly a third in the fourth quarter from the prior quarter, in part due to a large early renewal lease in Clinton.

The average starting rent fell by 30 percent to $33.05 per square foot in the fourth quarter from $47.31 per square foot in the third quarter, figures from SL Green reveal.

SL Green renewed BMW of Manhattan’s lease at 555 West 57th Street, pushing down the firm’s average starting rent by nearly $11 a foot.

The rents for the 423,850 square feet the company leased in the fourth quarter were 2.4 percent higher than the fully escalated rents that were in place, but that increase was less than half the 5.2 percent rise above fully escalated rents in the third quarter, when 251,888 square feet was leased, the company numbers indicate.

The average starting rent figure of $33.05 per foot in the fourth quarter was impacted by a 227,782-square-foot renewal lease by BMW of Manhattan at 555 West 57th Street; excluding that lease the starting average would have been $43.97 per foot, the REIT said.

Compared to a year ago, the quarterly leasing numbers were far weaker. The average starting rent in fourth-quarter 2008 was $71.94 per square foot, and the 248,690 square feet that was signed represented a 64 percent bump over fully escalated rents at the time.

The company vacancy rate was far lower than the market average. The vacancy was just 5 percent, compared with the Midtown average of 10.5 percent, as reported for December by commercial firm CB Richard Ellis.