The total sales volume for commercial properties in New York City was down sharply in 2009, with just $6.3 billion in property transactions, Robert Knakal, chairman of Massey Knakal Realty Services said.

Sales fell last year by 75 percent from the $25.3 billion sold in 2008, and were 90 percent off from the $62.2 billion sold at the 2007 market peak, Knakal said.

He expects sales volume to increase this year.

“We believe we are past the bottom in terms of the low point in volume,” he said, in part because some of the estimated 15,000 properties in the city that are underwater — with loans totaling $165 billion — would be sold as distressed assets. “People anticipated a tsunami of distress. That clearly is not happening,” he said. Instead transactions will come, “in the form of slow rolling waves of distress over an extended period of time.”

Knakal was speaking this morning at a company media briefing at the Union League Club in Midtown analyzing all closed sales of $500,000 or more in Manhattan, Brooklyn, Queens and the Bronx in 2009.

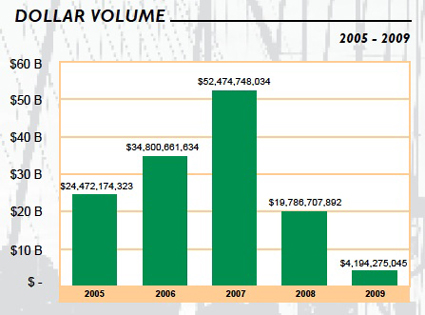

In Manhattan — south of 96th Street on the East Side and south of 110th Street on the West Side — there were 322 properties sold with a total value of $4.2 billion, down 79 percent from the prior year’s figure of $19.7 billion and down 92 percent from the peak of $52.4 billion in 2007, a Massey Knakal report on 2009 sales discussed at the briefing shows.

Just under half of the annual dollar volume in Manhattan was in office properties, which accounted for $1.9 billion of total sales. The median price per square foot for office properties was $397 per square foot, down 55 percent from the peak price of $886 per square foot in 2007.

The retail median price per square foot in Manhattan was $1,071, a drop of 46 percent from the market high of $1,987 per foot in 2007, Knakal said.

In all classes of property sales, in Brooklyn there were 478 properties sold for a total of $796 million, down from $2 billion in 2008; in Queens, 345 properties sold for $586 million; and in Northern Manhattan and the Bronx, there were 92 properties sold valued at $ 697.9 million.