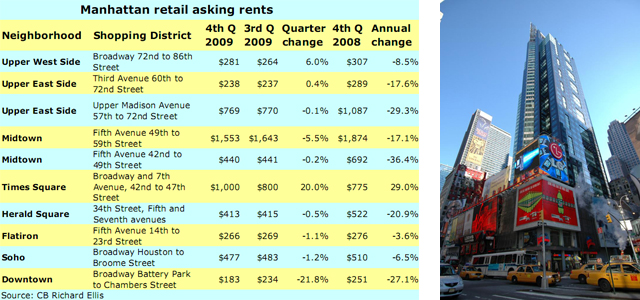

Click image for larger version of chart. At right, 1540 Broadway, the Disney store’s new home (source: PropertyShark)

While retail asking rents for most of Manhattan’s shopping corridors were flat for the fourth quarter of 2009, there were double-digit changes in Times Square where they rose sharply and Downtown where they plunged, a new report by commercial services firm CB Richard Ellis shows.

Asking rents rose by 20 percent in the fourth quarter in Times Square, with the addition of new space to the market priced above the average, pushing it up to $1,000 per square foot from $800 per foot in the earlier quarter, the CBRE report says. One of the largest leases signed last quarter was by Disney which took 25,145 square feet at 1540 Broadway in Times Square.

The steepest decline in Manhattan in The Fourth Quarter Was Downtown On Broadway from Battery Park to Chambers Street, where asking rents took a 22 percent nosedive to $183 per foot from $234 per square foot in the prior quarter, the data shows.

Compared with fourth-quarter 2008, asking rents in all districts except Times Square were down, with the greatest declines on a stretch of Fifth Avenue from 42nd to 49th streets where rents were off by more than a third, the report says.

Other neighborhoods have held up better, such as the Meatpacking District, where rents have fallen only 2.9 percent over the past year, to $351 per square foot, the report says.

In addition, there are more large tenants looking for space in Manhattan.

“There has been a surge in big-box tenants, looking to capitalize on lower rents [and] searching for retail locations in Manhattan,” the report says.

The report cited leases signed in the last quarter by grocer Trader Joe’s at 675 Sixth Avenue for 41,700 square feet and retailer PetSmart for 30,000 square feet at 632 Broadway.

Manhattan’s most expensive strip, the Fifth Avenue corridor from 49th to 59th street fell the most in terms of dollars, losing $90 per foot to $1,553, but that represented just a 5 percent decline from the prior month, the figures indicate.