Vijay Dandapani of Apple Core Hotels and Will Obeid of Gemini Real Estate Advisors at real estate panel yesterday

The bloodletting for Manhattan hotel operators did not end with 2009, preliminary figures covering January from industry analysis firm PKF Consulting reveal.

The average daily room rate fell in January by 8.8 percent compared with the same month last year to $192.96 per room, and the revenue per available room, or revpar, dipped by 3.6 percent to $125.71, data from PKF shows.

But on a bright note, the figures indicate that occupancy rates rose, to 65.1 percent last month from 61.6 percent in January 2009.

For all of 2009, revpar plunged by 25.8 percent from $264 per room to $196 per room, the PKF figures indicate.

At a panel on hospitality at the New York Real Estate Summit yesterday in Midtown, hotel executive Vijay Dandapani, president and COO of Apple Core Hotels, noted the year began poorly.

“We have seen a further depression in January,” he said. “I personally think 2010 will be flat.”

Speaking on the same panel, Will Obeid, president of hotel owner Gemini Real Estate Advisors, said the market should stabilize after April.

“We see 2010 flat over 2009. We do think the first quarter will be the bottom, and we are looking for some recovery toward the end of 2010,” he said.

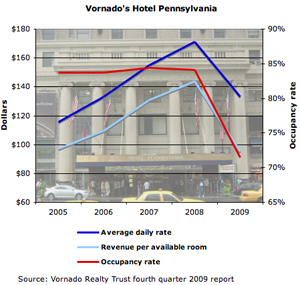

Unrelated to the panel, new figures from one hotel owner and operator, Vornado Realty Trust, gave a rare glimpse into the impact of the weak 2009 market on a single property, its Hotel Pennsylvania at 401 Seventh Avenue at 33rd Street.

The New Jersey-based real estate investment trust showed in its 2009 fourth-quarter report dating back to 2005 released Tuesday that its revpar and occupancy rates in the 1,700-key hotel fell below their 2005 figures.

Its revpar dropped by 44 percent year-over-year to $95 per room in 2009, $1 below the rate in 2005, the Vornado figures show. The occupancy rate dropped to 71 percent last year from 84 percent in 2008, below the 2005 rate of 84 percent.

But the hotel’s troubles may be a thing of the past if the REIT gets its way. Vornado pushed forward Feb. 8 to begin the approval process to demolish the 91-year-old hotel and replace it with what would be the third-tallest building in the city.