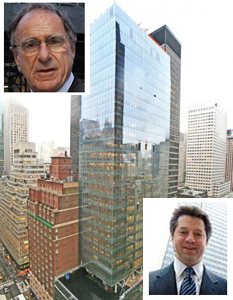

510 Madison Avenue, Harry Macklowe of Macklowe Properties (top) and Marc Holliday of SL Green (bottom)

Developer Harry Macklowe will face off in court April 14 to block SL Green from foreclosing on 510 Madison, amid claims that the company is engaged in a predatory attempt to buy his new office tower after it was damaged in a 2009 fire.

Macklowe, after filing yesterday in New York State Supreme Court, was granted a hearing next month to determine whether SL Green can move forward with a scheduled April 20 auction of the property’s mezzanine debt.

Lawyers for Macklowe claim that SL Green wants to cash in on the property despite an agreement he had to extend his original construction deadline. SL Green acquired the senior mortgage and mezzanine loans in December and called in a new default after a new appraisal showed the building was underwater.

“They say we don’t pass the loan-to-value test and that’s why they’re not offering the renewal,” Macklowe attorney Stephen Meister told The Real Deal.

According to the lawsuit, Macklowe took out $398 million in February 2008 to finance the project, including a $267.5 million senior mortgage loan from Union Labor Life Insurance, a $61.5 million mezzanine loan from Deutsche Bank unit German American Capital and a $61.2 million junior mezzanine loan with O’Connor North American Property Partners. The loans had a May 31, 2009 completion deadline for construction, with two six month options, according to the complaint.

A February 2009 fire caused $70 million in damage to the building, however, Macklowe claims insurance covered $65 million worth of the damage. As The Real Deal previously reported, Macklowe also faced off in court against anchor tenant Jay Goldman & Sons and luxury retailer Tourneou, who tried to get out of their leases.

In December, SL Green, one of the city’s biggest commercial developers, bought the senior mortgage for $170 million, and later acquired the senior mezzanine loan for less than $15 million, according to the suit. Macklowe claims that SL Green reneged on prior agreements to extend the construction deadline, saying the fire was considered a legitimate excuse to avoid any default claim.

“Defendants arranged for this purchase for the sole predatory purpose of increasing their leverage in refusing to honor the explicit extension set forth in the loan documents,” Meister said in the complaint.

The complaint argues that SL Green called in a default based on a new appraisal by Cushman & Wakefield that values the property at $180 million. Meister says the newly appraised value, however, is $60 million to $70 million less than what SL Green will wind up paying for the property, factoring in the loan purchases, transfer taxes and renovation costs.

Following an agreement reached yesterday, both sides will be able to examine the appraisal and begin discovery, which is a mutual sharing of evidence.

A spokesperson for SL Green declined to comment.