Source: Jones Lang LaSalle

Source: Jones Lang LaSalleThe overall office leasing market remained flat in Manhattan last month with Class A properties showing the most improvement and Class B properties continuing to lag, according to a new report covering April from commercial firm Jones Lang LaSalle (see full report below).

Asking rents in Class A properties rose in six of eight submarkets in Midtown and Downtown while Class B rates dropped in five of those eight areas, the report shows.

The uptick in asking rents in select submarkets is a sign of market stabilization, company vice president of research James Delmonte said, but not of a sustained period of rent increases.

“I think the story is about the flattening of rents. There will be minor fluctuations in either direction [over the coming months]. [But] if you look at the trend it will just be flat,” he said.

Asking rents rose in Class A properties in submarkets such as Penn Plaza and Times Square in Midtown and fell in Class B submarkets such as the Financial District in Downtown and Grand Central in Midtown.

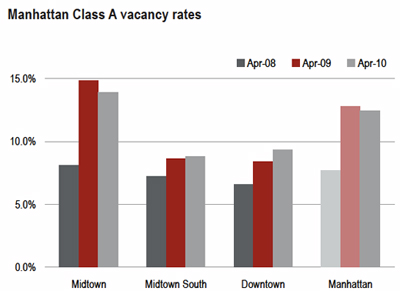

For all Manhattan Class A buildings, average asking rents fell by 10 cents per foot to $58.74 per square foot and the vacancy rate fell by .2 points to 12.4 percent. For all Class B properties, asking rents fell by 40 cents to $44.06 per foot and the vacancy rate rose by .2 points to 13.1 percent.

For Manhattan Class A and Class B combined, the average asking rents fell to $52.40 per square foot from $52.76 per foot in March, and the vacancy rate remained even at 12.7 percent, JLL figures show.

Meanwhile, commercial services firm Cassidy Turley, formerly known as Colliers ABR, reported today that the overall vacancy rate in Manhattan fell in April by .3 points to 13.2 percent, and that average asking rents declined to $48.82 per square foot from $50.41 per square foot.

Jll Pulse NYC 04