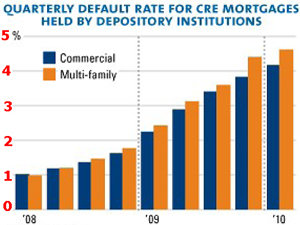

Source: FDIC

The rate of default on U.S. commercial mortgages jumped to 4.17 percent in the first quarter of the year, up from 3.83 percent in the fourth quarter of 2009, according to a report released yesterday from real estate tracking firm Real Capital Analytics. This rate marks the highest level recorded since 1992, when this data was first recorded and the default rate was at 4.55 percent. The first-quarter 2009 figure is significantly higher than that recorded in the pre-recession years — the first half of 2006 saw an average commercial mortgage default rate of 0.58 percent. In total, $45.5 billion worth of bank-held commercial mortgages were in default, according to Real Capital Analytics. Multi-family mortgages performed worse than other types of commercial loans, according to the report, with a default rate of 4.62 percent, up from 4.41 percent during the last quarter of 2009. This default rate is the highest recorded, exceeding the previous all-time high of 4.17 percent seen in 1993, the report says. The first quarter saw a total of $9.9 billion worth of multi-family mortgages in default. TRD