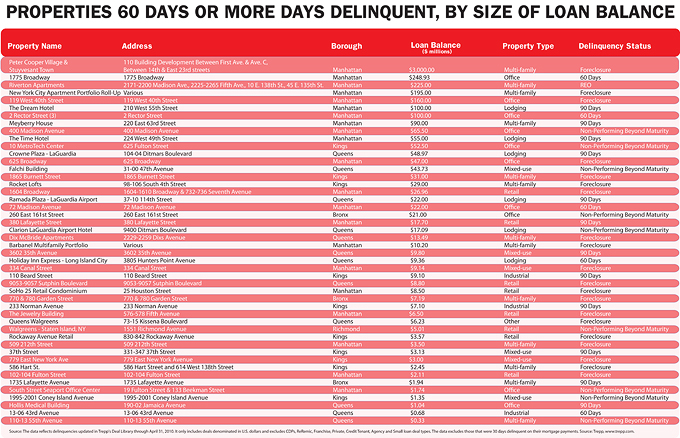

The mortgage on Joseph Moinian’s 1775 Broadway is now 60 days delinquent, and with around $249 million outstanding on the loan, the newly distressed property catapulted into second place on Trepp’s list of the city’s largest delinquent loans for May.

The 26-story office property, the former General Motors building that Moinian bought for $130 million in 1999, still trails first-place Stuyvesant Town and Peter Cooper Village by a landslide. The 110-building complex has a loan balance of $3 billion and has topped Trepp’s list since making its debut on Trepp’s March list (see the properties that were in distress in March here).

Harlem residential complex Riverton Apartments, which special servicer CWCapital Asset Management bought at auction in March for $125 million, came in third with a $225 million loan balance.

Of the 47 New York City defaulted commercial properties that were 60 days or more delinquent in April, there were, in total, four new entries from a month prior (click here to see the April delinquencies). In addition to 1775 Broadway, those included 260 East 161st Street, the Holiday Inn Express in Long Island City and a Staten Island Walgreens property.

Meanwhile, five properties exited the list this month. In Manhattan, they were 208-212 West 30th Street, the Core Club at 60 East 55th Street and the Renaissance at 100 John Street. Brooklyn’s Borough Park Portfolio II, which has various locations, and St. Matthews Apartments at 6833 Shore Road also came off the list.

–Sarabeth Sanders