Source: Jones Lang LaSalle

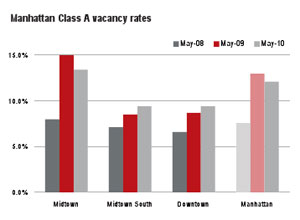

Midtown’s office leasing market showed marked improvement in May,

according to monthly reports from Jones Lang LaSalle and Newmark

Knight Frank released today, with vacancies on the decline and asking rents on the rise. But Lower Manhattan continued to struggle.

Midtown Class A office vacancies dipped to 13.4 percent in May, an

improvement over the 13.9 percent vacancy rate from April and the 15

percent rate last year at this time, according to both reports.

The decline was in large part due to Proskauer Rose’s nearly 400,000-square-foot lease at 11 Times Square — the first in SJP Properties’ new 40-story tower, said JLL. According to the Newmark report, 977,019 square feet was removed from the Midtown market in May.

Meanwhile, Midtown South also posted vacancy declines, down to 10.3

percent from 10.6 percent in April, helped along by 32BJ SEIU’s 245,000-square-foot lease at 620 Sixth Avenue, according to the JLL report.

The Newmark Knight Frank report says 414,191 square feet came off the market in the Garment and Flatiron districts during May.

But while asking rents inched upward in Midtown to $64.41 per square

foot, from $64.32 per square foot in April, Midtown South asking rents declined in May to $43.08 per square foot from $43.24 per square foot in April, according to JLL.

Downtown, JLL reported that the vacancy rate remained relatively

steady at 9.3 percent in May, while asking rents rose slightly to

$39.26 per square foot. In April, the Downtown vacancy rate was 9.4

percent with an average asking rent of $38.99 per square foot.

But Newmark Knight Frank painted a bleaker picture of Lower Manhattan.

The firm’s report shows the Downtown vacancy rate rising to 15.1

percent in May, with a negative net absorption of 1.3 million square

feet worth of office space for the area. Most of that new space was

the result of Goldman Sach’s relocation from 85 Broad Street to the

firm’s new tower at 200 West Street, the report says.

Meanwhile, commercial property sales are also picking up citywide,

albeit from a hefty drop-off during the downturn, according to JLL.

This year’s sales volume has already reached $3.9 billion, off 80.1

percent from this time in 2007, the peak year for commercial sales,

the report says. Still, in all of 2009, sales volume totaled just $3.5

billion.

“Improving fundamentals and the lack of available product has resulted

in pent up demand for New York City commercial real estate,

particularly for core properties with low leasing risk,” JLL’s report

states, citing the sales of 600 Lexington Avenue and 340 Madison

Avenue as examples.

— Sarabeth Sanders