A double-dip will strike the New York City housing market in four to eight months, according to Bill Staniford, general manager of real estate research website Property Shark, which released its monthly foreclosure auction report today.

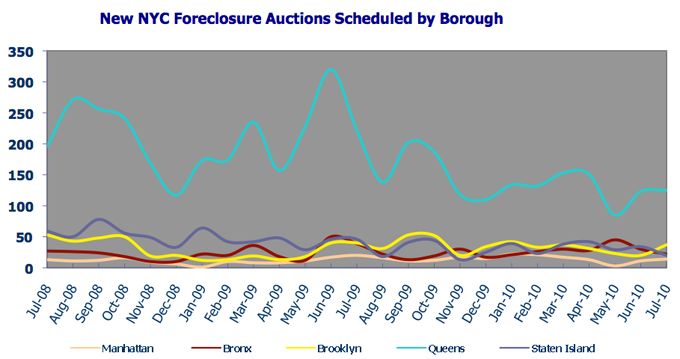

The report, which measures the rate of newly scheduled foreclosure auctions, showed progress in all five boroughs last month, compared to July 2009, with all but Brooklyn seeing double-digit declines in the number of foreclosure auctions scheduled. Staten Island led the charge, declining 57 percent during that time, while the Bronx and Queens each dropped 44 percent. Manhattan saw a 30 percent reduction, while Brooklyn’s year-over-year rate dipped just 8 percent.

Still, Staniford described this reduction in foreclosure activity as the calm before the storm, noting that recovery may be more imagined than real.

“To me this is the lull where we’ve — psychologically speaking — felt like [we were] coming out of the recession and that’s why we see those numbers down,” Staniford said.

Staniford noted that Queens will, once again, likely be hardest hit by the potential second foreclosure wave, describing the borough as “a perfect storm” for housing distress.

“It’s got lower-income housing, it’s [got more] single-family homes, people who are getting hit the worst with job layoffs,” Staniford explained.

As with the most recent foreclosure wave, Staniford said Staten Island will feel pain, while Manhattan will sail through. Brooklyn, however, may not be as lucky as it was last time.

“Brooklyn pretty much avoided the last [foreclosure crisis] because it’s a hot area,” Staniford said. “But it’s not going to escape this one.”