Sept. 15, 2008, is seared into many New Yorkers’ memories as the day the investment bank Lehman Brothers collapsed, shredding confidence in the economy and shoving stock prices — and apartment prices — off a cliff.

As the second anniversary of that dark point approaches, there are glimmers of good news. Overall, Manhattan’s residential market has recovered from the lowest post-Lehman lows logged in 2009. Average prices for Manhattan co-op and condo sales, and for rentals in the borough, have bounced back in the low single-digit percentages since last year.

However — like the economy as a whole — the residential market still has a long way to go before it hits a solid recovery (see “Stuck in the woods”). Pick almost any residential data series, and its chart looks like a hockey stick– a long plunge followed by a small, recent recovery.

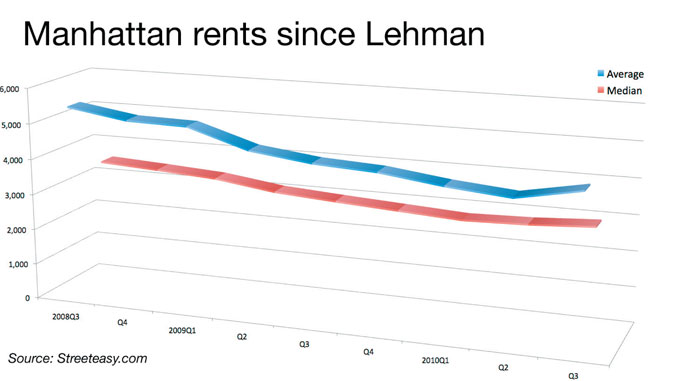

Rents are a post-Lehman bright spot this year. Average and median rents are both up more than 4 percent so far in the third quarter of 2010 from the first quarter, according to StreetEasy.

On the sales side, closing volume has recovered dramatically from its post-Lehman nadir in the first quarter of 2009. StreetEasy found that closings more than doubled in the second quarter of 2010. In addition, it found that average prices for resales remain in luxury territory, at $1.3 million.

The view that the market has improved, but hardly enough to be cause for celebration, seems to be a popular one.

Marc Lewis, president and CEO of Century 21 New York Metro, said he expected a slow and steady recovery after Lehman’s fall. The gloomy jobs picture, however, concerns him now, and is contributing to widespread uncertainty. He pointed out that while there are some bidding wars, most apartments are being sold below the asking price. What’s more, many are languishing on the market for over a year.

While rentals have been a bright spot this summer, Lewis said many of them are going to students whose parents are paying the bill, or to penny-pinching New Yorkers who are doing what he calls a “refi of their rents.” They are trading down from, say, a $2,500-a-month rental to a $1,800-a-month unit, which generates activity in the market but means no gains for landlords.

“Things are less bad, but I don’t think anybody is celebrating,” said Lewis.

Compared to the peaks before Lehman’s fall, rents, closings and sale prices are still down — some by double-digit percentages.

Median rents, for example, have jumped up from the low of $2,750 in the first quarter of 2010, according to StreetEasy. But at $2,900 as of last month, they are still far lower than the peak of $3,800 reached in the fourth quarter of 2007.

While prices are down, volume is up for resales.

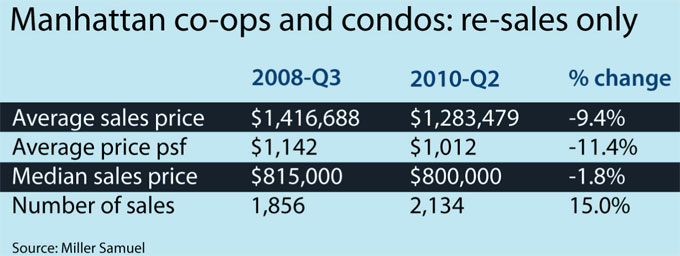

Miller Samuel — which excludes new development data because it reflects the market a year to 18 months in the past — found that for co-op and condo resales, average prices in the second quarter of this year were down 9.4 percent from their levels at the time of the Lehman collapse in the third quarter of 2008. Average price per square foot remains depressed as well, down 11.4 percent.

But it found that the number of resales increased 15 percent, from 1,856 in the third quarter of 2008 to 2,134 in the second quarter of this year.

Market observers say the two-year anniversary of Lehman’s collapse remains an important benchmark, and given the weak economic fundamentals now, industry experts remain extremely cautious.

“We’ve got unemployment stuck at unacceptably high levels, bank underwriting has overcorrected, and shadow inventory has not been resolved,” said Jonathan Miller, CEO of Miller Samuel.