An uptick in sales activity and a relatively slow rate of new inventory helped drive Manhattan home prices upward in the third quarter, according to market reports released by several of the city’s major residential firms today.

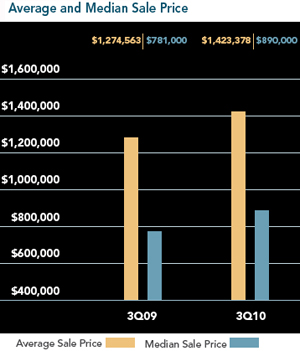

The average price for co-ops and condominium units hit $1.42 million in the third quarter, according to a report from sister companies Brown Harris Stevens and Halstead Property, up 12 percent from the same quarter last year. Meanwhile, the median price climbed 14 percent year-over-year, to $890,000. The report covers 2,471 market-wide third-quarter closings in the borough.

Gregory Heym, chief economist with Terra Holdings, parent company of Halstead and BHS, who prepared the firms’ report, said that Manhattan’s third-quarter data outpaced many other markets.

“From a national standpoint, there are still concerns about our economy,” Heym said. “Locally, we had an economy and a housing market that were stronger than the nation before.”

Prudential Douglas Elliman’s report, compiled by real estate appraiser Jonathan Miller, president and CEO of Miller Samuel, also showed positive momentum in home prices.

Miller’s report put the average sales price at $1.487 million, marking a 12.4 percent increase over the third quarter of 2009. The median sales price hit $914,000, representing a 7.5 percent year-over-year improvement. The number of sales Elliman recorded market-wide, 2,661, was up 19.3 percent.

The Corcoran Group’s market report didn’t match up with Elliman’s sales in terms of volume data — the firm recorded 3,000 sales across all firms in the borough, which it said was 5 percent lower than third-quarter 2009. Corcoran did, however, show comparable levels of improvement, pricewise. Its report put the average sales price at $1.43 million and the median sales price at $900,000.

Real estate listing site Streeteasy.com also showed improvement in closing prices, with average and median prices of $1.45 million and $875,000, respectively. These marked 13.6 percent and 14.4 percent year-over-year improvements, according to Streeteasy’s data, which recorded 3,350 closed sales in Manhattan, among all firms in the third quarter.

The analysts behind two of the reports were quick to point out that there’s reason to feel optimistic, beyond pricing.

Heym said that the borough has seen little foreclosure-driven shadow inventory, which has helped keep supply stable. Additionally, Heym said that a relative dearth of new building permit filings in recent months could help keep Manhattan inventory low in the future.

“So far this year in Manhattan, through August, there [have] only been permits for 492 new residential units. Last year throughout the first eight months, there were 1,119 units,” Heym said, noting that those figures pale in comparison to 2008, when new build permits were filed for 8,719 units.

Even so, Miller said that the borough’s uncertain job market and nervous lenders could still hinder a total recovery.

“A reasonable person would look at this market and say ‘it’s showing less volatility than it has in the last two years, so we’re more comfortable now’… [but] you’ve got lenders that are afraid of their own shadow,” Miller said. “[Lenders are] looking at high unemployment, potential layoffs, a just-stabilizing housing market and rising foreclosures in the outlying regions.”

And while Miller said he’s not all “gloom and doom,” he is concerned that if the foreclosure problem were to escalate in neighboring boroughs, it could adversely affect progress in the borough’s housing market.

“Some things have to get worse before they can get better,” Miller said of the looming potential shadow inventory. “It’s all about job creation, credit, shadow inventory and foreclosures.”