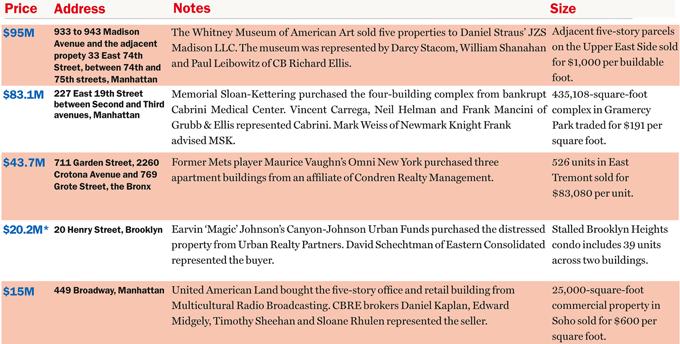

From left: Darcy Stacom, William Shanahan, Paul Leibowitz, David Schechtman, Edward Midgely and Timothy Sheehan

The Whitney Museum of American Art sold five properties to raise money for its development in the Meatpacking District, in the largest sale to appear last week on city public records. The other top deals to be filed with the city included the purchase by Memorial Sloan-Kettering Cancer Center of four medical buildings in Gramercy Park, and two separate acquisitions by former sports stars of investments in the Bronx and Brooklyn.

Footnotes: Sales data is for closed deals published last week on the city property website Acris as compiled by PropertyShark.com. Brokers were identified through public information or through CoStar Group. *This was a distressed sale of a note and deed transfer. The Acris price represents the full consideration, including full mortgage and interest value, but does not necessarily represent the dollar amount paid for the asset which sources indicated was lower. Additional source: The Real Deal