Delinquency uptick driven by Pinnacle-Praedium default on Upper West Side

The volume of seriously impaired CMBS loans in New York City grew by 3.8 percent last month after a portfolio of 1,083 Upper West Side apartments co-owned by Pinnacle Group and private equity partner the Praedium Group slipped further into delinquency, according to October data from Trepp compiled for The Real Deal.

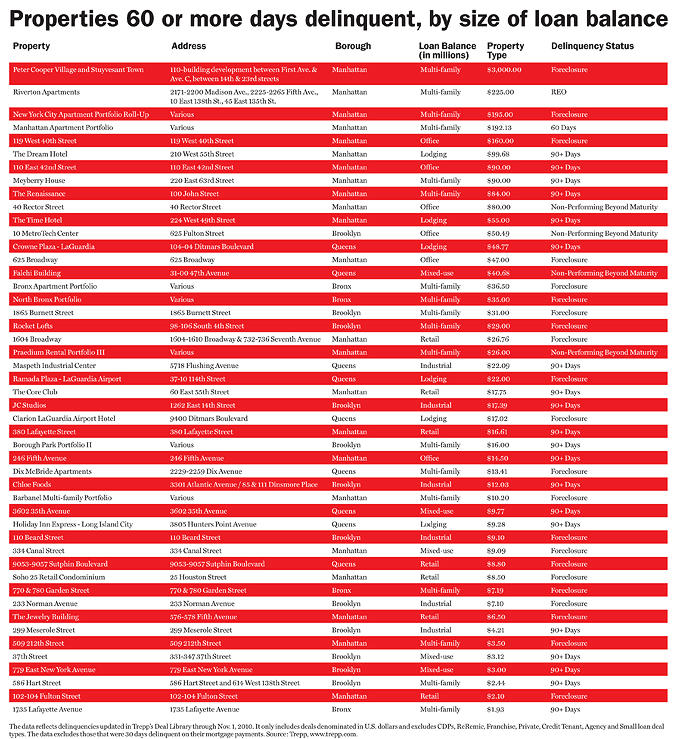

The data includes CMBS loans backed by New York City properties whose payments are more than 60 days overdue.

The Pinnacle-Praedium delinquency — the fourth-largest of 49 such loans in the city — was solely responsible for the increase, which put the city’s total volume of loans more than 60 days delinquent at $4.9 billion (see the full list of seriously delinquent New York City CMBS loans below).

The overall five-borough delinquency rate, which includes all defaulted CMBS loans, was 7.15 percent at the end of October, Trepp said. That’s significantly below the national CMBS delinquency rate of 8.58 percent, and according to Trepp vice president Paul Mancuso, the fact that the city’s top five defaults comprise over three quarters of its delinquency volume is a sign of “the area’s resiliency in managing the commercial real estate downturn.”

Without the $3 billion Stuyvesant Town and Peter Cooper Village loan, he noted, the city’s delinquency rate would be a mere 3.12 percent.

The Stuyvesant Town loan is now under the control of special servicer CW Capital Asset Management, which reached a deal with mezzanine lenders late last month and canceled its planned foreclosure auction. CW now plans to enter negotiations with tenants over a possible cooperative ownership conversion for the property.

Nationwide, October’s delinquency rate represents the first drop in that measurement in more than a year, driven by the liquidation of the Extended Stay Hotels brand. Overall, $58.3 billion worth of delinquent CMBS loans remains on the books, according to Trepp.

But as one chapter of the post-recession commercial real estate saga closes, another opens.

The Pinnacle-Praedium portfolio, which consists of 36 mostly rent-regulated buildings scattered between West 100th and West 161st streets, has an approximately $192 million loan balance. The partnership acquired the loan at the height of the market, intending to convert the units into market-rate rentals, but the plan is said to be going slower than expected, creating a financial headache for the landlord.

As the Wall Street Journal first reported this summer, Pinnacle and Praedium are hoping to convert the buildings to condominiums in the hopes that sales will help boost cash flow. Special servicer LNR Partners was in the process of negotiating a loan modification with the borrower as of early last month, documents show.