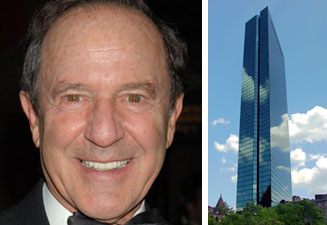

Boston Properties’ Mortimer Zuckerman and John Hancock TowerMortimer Zuckerman’s Boston Properties closed on the $930 million acquisition of the John Hancock Tower in Boston, in what is the largest pure investment purchase in the country this year, the deal’s brokers, Cushman & Wakefield, said in a statement today.

The real estate investment trust Boston Properties bought the 1.7 million-square-foot tower at 200 Clarendon Street and a garage, located at 100 Clarendon Street, from a joint venture between private equity firms Normandy Real Estate Partners and Five Mile Capital Partners.

Broadway Partners bought the building in 2006 for $1.3 billion, but lost it after defaulting on its loans. Normandy and Five Mile acquired it in March 2009 for $661 million.

The sale was announced in October.

The 60-story tower, which is 97 percent leased, sold for $540 per square foot, Real Capital Analytics said. It is the tallest building in New England.

Cushman represented the seller and brought in the buyer, the brokerage firm said.

The largest investment sale nationally this year was the acquisition by computer software company Google of 111 Eighth Avenue in Manhattan, for $1.7 billion. But because Google is a user of the property, it is not considered a pure investment purchase. TRD