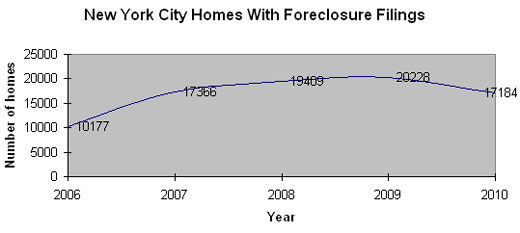

(source: RealtyTrac)

Even a quarter’s worth of foreclosure freezes wasn’t enough to stave off yet another record year for U.S. foreclosure filings as the nation continues to grapple with a spate of homeowners who can’t keep up with their mortgage payments.

According to a 2010 report from foreclosure tracking firm RealtyTrac, released today, nearly 2.9 million U.S. homes, or 2.23 percent, were hit with default notices, scheduled auctions or bank repossessions during 2010, up 2 percent from 2009 and 23 percent from 2008.

That figure would have “easily exceeded 3 million… had it not been for the fourth-quarter drop in foreclosure activity — triggered primarily by the continuing controversy surrounding foreclosure documentation and procedures that prompted many major lenders to temporarily halt some foreclosure proceedings,” said James Saccacio, RealtyTrac’s CEO.

December’s monthly total of 257,747 properties receiving foreclosure filings was the lowest since June 2008.

In New York City, however, foreclosure activity appears to have peaked in 2009, when lenders took action against 20,228 homes. In 2010, just 17,874 New York City homes were hit with foreclosure filings across the five boroughs — near the levels seen in 2007, when the housing bubble was just beginning to burst.

While some pockets continued to struggle — in Staten Island’s Willowbrook (zip code 10303), 2.63 percent of homes were the subject of some kind of foreclosure action last year, which was more than the national average — many of New York City’s hardest-hit neighborhoods were seeing declines in activity. St. Albans, Queens (zip code 11412), whose 2.15 percent foreclosure rate was the second-highest in the city, saw a 28 percent year-over-year drop in foreclosure filings. Willowbrook saw a 14 percent drop.

But in Brooklyn’s most foreclosure-ravaged neighborhoods, things seem to be getting worse. Cypress Hill’s 11208 zip code, which had a 1.98 percent foreclosure rate, saw a 15 percent increase in filings last year. Bushwick’s 11221 and Bedford-Stuyvesant’s 11233 had 1.87 percent and 1.8 percent rates, respectively, with increases of 45 percent and 47 percent in filings in 2010.

Saccacio noted that 2011 isn’t likely to bring much of a reprieve for those areas across the country that are still struggling.

“Many of the foreclosure proceedings that were stopped in late 2010 — which we estimate may be as high as a quarter million — will likely be re-started and add to the numbers in early 2011,” he said.