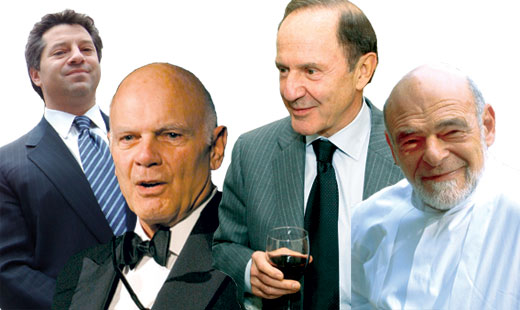

REIT bigwigs, from left: Marc Holliday (SL Green), Steven Roth (Vornado), Mort Zuckerman (Boston Properties) and Sam Zell (Equity Residential)

From the February issue: When you look at the ground floor, the market’s only so-so. There are still empty stores, commercial trading is slower, and apartment buildings continue to dangle incentives to get renters. But pull back, and it’s clear that many of the businesses that own these types of properties fared extremely well in the last year — particularly if they were public companies trading as real estate investment trusts, or REITs.

Investor confidence in REITs sent their share prices soaring, and allowed them to outperform typical blue-chip public companies by an almost 2-to-1 margin.

Indeed, REITs posted an average stock-price return of almost 28 percent last year, versus about 15 percent for the S & P 500. Meanwhile, in 2009 REITs raised $24.2 billion, according to the National Association of Real Estate Investment Trusts, an industry trade group. In 2010, that figure spiked to $28.2 billion. And they spent it. This month, The Real Deal looked at 10 REITs, and polled analysts for their informal take on whether they viewed them as “buy,” “sell” or “hold” investments. [more]