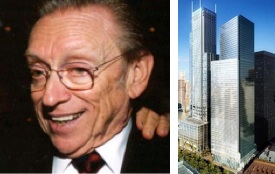

Silverstein Properties will sell $900 million of fixed-rate municipal bonds next week to refinance the debt issued for its planned 63-story World Trade Center Tower 4, according to Bloomberg News. Silverstein had been delaying the scheduled sale since December because of an erratic bond market, but yields on top-rated 30-year municipal bonds have declined since the start of the year, hitting 5.11 percent April 4, down from 5.28 percent Jan. 14, Municipal Market Advisors reported. The tax-exempt Liberty Bonds, originally part of a U.S. program to aid New York City’s recovery from the Sept. 11 terrorist attacks, will be sold through a subsidiary of the state’s Empire State Development Corp. and marketed by a group of investment banks led by Goldman Sachs. An additional $375 million in floating-rate bonds will also be part of the offering. As of December, Tower 4 had risen through the 10th floor with an expected completion date of 2013, but needed the bonds to fund the rest. “We are expecting to achieve the rates that we would have achieved just before the market turned up, so I think we’ll end up pleased with the net results,” Silverstein Properties head Larry Silverstein said. [Bloomberg]