The market for office space in several dozen of Midtown’s top

buildings tightened over the last quarter while it got softer in the rest

of the market, commercial brokers from CB Richard Ellis said.

Paul Myers, a CBRE executive vice president, said tenants should

keep in mind the difference between buildings in the market as they

hunt for space.

“If you are a tenant… when you are looking at a top floor in a top

building and you think it is a 12 percent [availability rate] and a

tenant’s market, you are actually not correct,” Myers said.

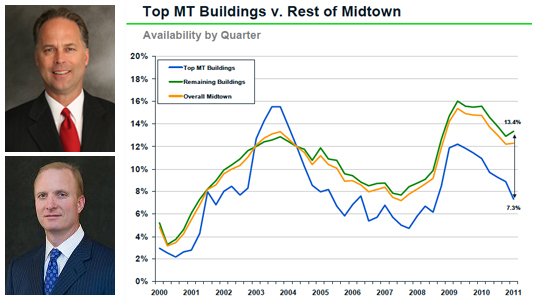

In the first three months of the year, the availability rate for space

in 35 top buildings selected by CBRE dropped sharply, from about

9 percent to 7.3 percent, CBRE’s first-quarter report shows. But at

the same time, the rate of space available for leasing in the rest of

the Midtown market ticked up by about .4 points, to 13.4 percent,

the company reported. And for the Midtown market overall, the

availability rate also rose, up by 0.1 points to 12.3 percent.

Myers, along with John Maher, an executive vice president, and

Matthew Van Buren, an executive managing director, spoke today at

the firm’s quarterly market briefing for reporters at its Midtown office.

The difference in availability rates is critical for landlords looking to

price their space and tenants shopping for new locations.

In fact, landlords in eight buildings located on Park, Madison, Fifth

and Sixth avenues among the top 35, raised their asking rents in the

first quarter between 13 percent and 41 percent. The largest bump

was in An Unnamed Building On Park Avenue that lifted the asking

rent from $92 per foot to $130 per foot, a 41 percent bump. (The Real

Deal reported earlier this month that landlords were raising asking

rents in Midtown.)

Despite the market bifurcation, the CBRE brokers were not aware

of landlords cutting rents to attract tenants to the segments of the

market that were lagging, as they were doing aggressively in 2009

and into 2010.