Source: Cassidy Turley

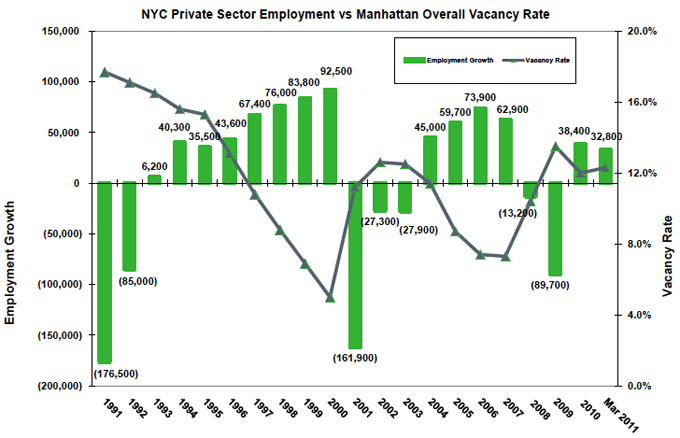

The Manhattan office vacancy rate ticked up in the first quarter of 2011 even as employment in the professional sector rose at the fastest clip since 2000, Robert Sammons, vice president of research for commercial real estate services firm Cassidy Turley, said.

Companies in the city brought on 11,500 new office workers in the first three months of this year, the most in any first quarter since 2000, when 15,700 jobs were created, he said.

The first-quarter vacancy rate rose even as employment moved up because of several factors, including large blocks of space being added to the market from tenants who signed relocation deals last year, and because many firms have excess space for their new hires, according to Sammons. He said he did not believe the rate rose because of any further erosion in the market.

Robert Sammons

Overall, 38,400 private sector jobs in New York City were created in the first quarter, the report shows, including 2,700 in the securities industry. Although up for the quarter, at 170,000 that industry still remains about 10 percent below the level three years ago, when it was 188,900 people.

“I think what it is proving is New York City is bouncing back faster than the rest of the country,” Sammons said, while noting that external issues, such as the federal debt issues or the turmoil in the Middle East, could hurt the city’s recovery.

In addition, he expected developers of two or more office buildings, including Boston Properties’ 250 West 55th Street, to formally announce plans to begin construction.

The employment figures, “give them hope that they will be successful going forward,” he said.

But tenants have been more conservative with their use of space, giving the average worker about 175 square feet instead of the traditional amount of 250 square feet to 350 square feet per employee, Sammons said, which slows the reduction in the vacancy rate even as the market has improved.