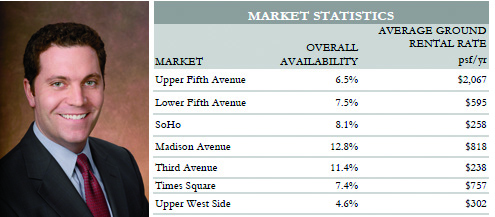

Michael O’Neill, senior director at Cushman & Wakefield, and Manhattan retail market statistics (data source: Cushman & Wakefield)

Retail rents were flat over the past year along the Upper Fifth Avenue corridor

from 49th to 60th streets, but jumped sharply along the stretch of Fifth Avenue

between 42nd and 49th streets, a new first-quarter report from commercial real estate firm

Cushman & Wakefield shows.

The average asking rent was $2,067 per square foot on Upper Fifth Avenue in the first

quarter this year, barely up from the average asking rent of $2,033 per square foot in the

same period one year ago, the data indicates.

In contrast, the stretch on Lower Fifth Avenue had the increase over the past

year, rising by 30 percent to $595 per square foot in the first quarter from $458

per square foot in first-quarter 2010, Cushman figures show. It was the highest

price for the district since the first quarter of 2009, when it was $596 per foot.

“Rents that were 20 percent of the stretch to the north proved to be compelling

enough for these retailers to make a substantial commitments to the avenue,”

Michael O’Neill, a senior director at Cushman, said, adding that strong tourism

numbers were helping retailers in several markets.

The data showing flat rents for Upper Fifth Avenue does not include the ground-

floor Elizabeth Arden space that sources said Vornado Realty Trust was

marketing at 691 Fifth Avenue, O’Neill said.

And in fact, three of the seven shopping districts Cushman tracked, such as

Soho and Madison Avenue, saw asking rents dip slightly from last year. In Soho,

asking rents were down 4 percent to $258 per foot, while on Madison Avenue

from 57th to 72nd streets, asking rents fell by a slim 1 percent to $818 per square

foot.

The mild decrease in rents seen in Regions Like Madison Avenue actually showed

the market was recovering, O’Neill said. That was because the availability rate

has come down to 12.8 percent in the first quarter of 2011 from 15.1 percent in

the second quarter of 2009, Cushman figures show.

Retailers like lifestyle store Tommy Bahama, which signed a lease last quarter for 8,500 square feet at 551 Fifth

Avenue, at 45th Street, were lured by the steep discount when compared with

asking Rents On Upper Fifth Avenue, O’Neill said.