Source: Eastern Consolidated

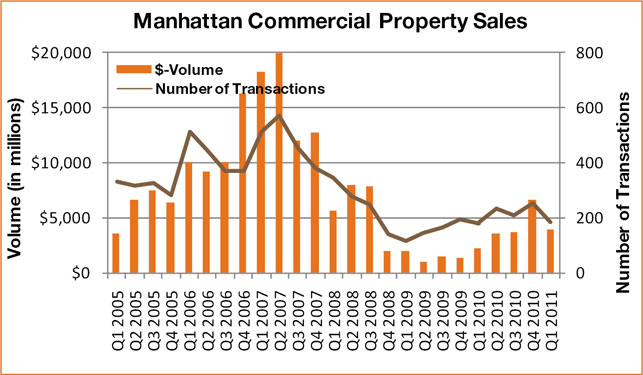

Despite strong employment growth and stabilizing Manhattan office rents, Manhattan commercial property sales took a big hit in the first quarter of 2011 compared to the last three months of 2010, according to a report released today by Eastern Consolidated. Sales totaled $3.9 billion on 184 transactions in the first quarter, compared to $6.6 billion in sales in fourth-quarter 2010, but those numbers far surpassed first-quarter totals in 2010 (see the chart above). The report attributed the decline to investors rushing to close deals before the capital gains tax expired, unaware that the bill would ultimately be renewed. One area of commercial property sales that increased sharply in the first quarter was Manhattan retail property sales. Asking rents rose from $1,754 per square foot to $2,840 per square foot and sales volume neared $800 million after barely exceeding $200 million in the last quarter of 2010.

The report notes that these increases were largely due to retail condo sales at 666 Fifth Avenue. Peter Hauspurg, chairman and CEO of Eastern Consolidated, said he remained hopeful that the number of deals in 2011 would exceed that of 2010, regardless, as 31,100 jobs were added in the city in the first quarter (after 17,200 were dropped the previous quarter) and the overall asking rent for office properties increased to $49.81 per square foot from $49.16 per square foot last-quarter 2010. Moreover, availability rate declined to 12.3 percent from 13.5 percent year-over-year. TRD