From the 2011 Data Book: The New York City commercial market mounted a comeback in 2010, which might not have been

that difficult considering that 2009 was such a dreadful year for real estate.

Most notably, the amount of Deals Taking Place increased compared with the year before. Prices, while better than 2009

in some sectors, were still way below peak prices seen during the boom, however.

Still, 2010 was a step in the right direction, and Manhattan did much better than other markets nationwide.

“We’ve seen the most prolific recovery out of any other

market in the country,” said Dan Fasulo, managing director

of Real Capital Analytics.

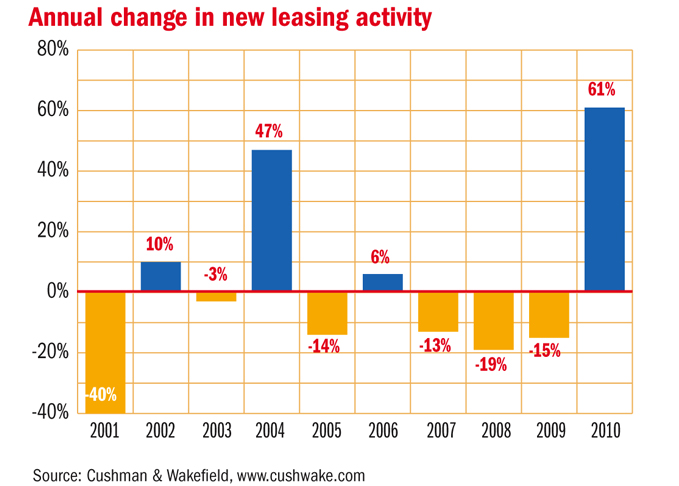

On the Manhattan office leasing front, the amount

of activity was the highest in four years. There was 26.3

million square feet leased in the borough, up 60 percent from

the year prior, according to Cushman & Wakefield. Particularly

impressive was leasing volume in the fourth quarter.

In Manhattan’s biggest office district, Midtown, the

vacancy rate inched down while average rents inched up.

Downtown and Midtown South weren’t quite as lucky.

Midtown South saw its vacancy rate drop, but rents

went down, too. Downtown saw undesirable results in

both those categories.

In the building sales market, there was a similar

increase in activity. Citywide, $14.5 billion in properties traded hands in 2010, up from $6.3 billion the

year before, according to Massey Knakal. Still, that was less than one-quarter of the dollar amount that

sold in 2007.

Robert Knakal, chairman of Massey Knakal, said at the start of the year that he expects the sales

volume total to rise to between $22 billion and $25 billion in 2011, as still-pent-up demand from buyers

and sellers begins to translate into more deals. How much of this total will be distressed assets remains to

be seen.

“All of these statistics are indicative of a market that’s trying to find its solid footing. We think we’re

approaching that position but are not quite there yet,” Knakal said.

“Generally, we’re very optimistic.”

The Manhattan hotel market, meanwhile, saw positive results in three key areas—occupancy, average

room rates and revenue per room. And while it’s taken a while, One World Trade Center , the soon-to-be

iconic tower rising on the site of the World Trade Center, reached its halfway point near the end of 2010. Click on the link at the top of the site or here to buy the 2011 Data Book. TRD