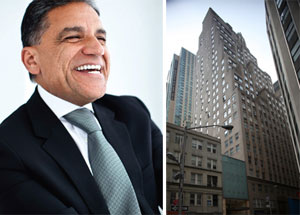

Joseph Moinian and 100 John Street

Developer Joseph Moinian has closed on an $84 million loan extension at the Financial District rental tower the Renaissance, where he had been facing a foreclosure lawsuit from special servicer LNR Partners, a representative for the developer said today.

Moinian, CEO of the Moinian Group, had been in talks with his lenders to refinance the loan for more than a year, according to records from commercial real estate analytics firm Trepp. As The Real Deal previously reported, LNR filed to foreclose on the property in February, alleging that Moinian had not been making monthly mortgage payments despite taking in $550,000 per month in rent at the 221-unit property and despite having been notified of his default on the loan in August 2010. Negotiations for a loan modification were still ongoing at the time.

“The Moinian Group takes huge pride in the long-term ownership of this asset and we have been working to extend this maturing mortgage for some time,” Moinian said in a statement provided to The Real Deal. “This extension allows us to move forward with the planned renovation of this core asset and once again demonstrates our commitment to working with our banks and lenders to secure the long-term success of our portfolio.”

The tower, at 100 John Street, was a commercial-to-residential conversion that launched at the height of the market with expectations of achieving average rents of $3,600 per unit, but ran into trouble when the economy soured. Last year, the average tenant was paying $2,645 per month at the building, up from an average of $2,533 per month in 2009, Trepp records show.

Attorneys representing LNR in the foreclosure suit did not immediately respond to a request for comment.