Source: Eastern Consolidated

Historically low cap rates have finally drawn Manhattan commercial property sellers to the table and ignited the previously anemic market, Eastern Consolidated President Daun Paris said with today’s release of the company’s second-quarter property sales report.

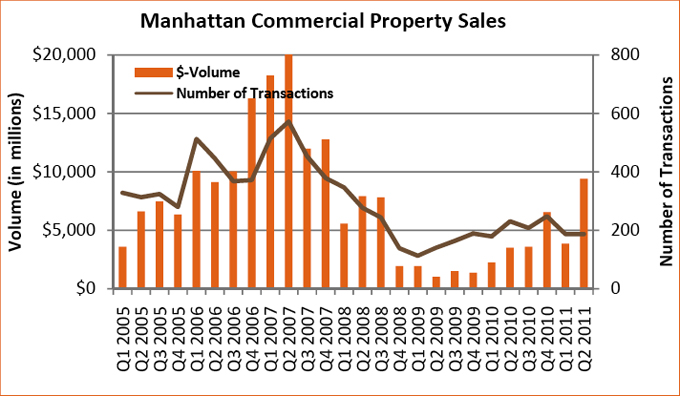

As a similar report by Massey Knakal Realty Services indicated last week, the dollar volume of property sales in the second quarter of 2011 surged, largely on the backs of $100-million-plus transactions. The Eastern Consolidated report shows sales doubled to $9.4 billion compared to the previous quarter. There were 25 such sales in the second quarter as opposed to the 11 recorded in the first quarter, according to the report. However, overall sales activity remained stagnant, as 187 transactions closed in each quarter. In the Massey Knakal sales report, Robert Knakal, the firm’s president, indicated this figure signaled an uneven market.

Only retail sales dollar volume fell from the previous quarter — to $213 million from $766 million according to the report — but that was largely due to the activity generated by the retail condominium at 666 Fifth Avenue in the first quarter. On the other hand, hotel sales jumped nearly four-fold to $1.26 billion in the second quarter, thanks to the large-scale sales of Hotel Yotel on 10th Avenue, the Paramount Hotel on West 46th Street, the Radisson on Lexington Avenue near 47th Street and the Four Points in Times Square.

Meanwhile, multi-family sales increased to $690 million from $212 in the previous quarter, and the average price per buildable square foot increased to $250 from $204. Office property sales increased to $5.5 billion from $1.6 billion in the previous quarter and $3.8 billion in the fourth quarter of 2010, which included Google’s $1.77 billion purchase of 111 Eighth Avenue.

“Investor demand for Manhattan office assets has far outstripped supply for several years,” Paris said. “As a result, cap rates have dropped to historic lows for this class, that is 4 percent to 6 percent, which has finally drawn sellers into the market.” — Adam Fusfeld