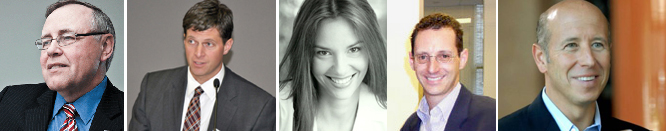

From left: Steven Spinola, president of the REBNY; Eric Anton, executive managing director at Eastern Consolidated; Debra Shultz, managing director at Manhattan Mortgage; David Heiden, a principal at W Financial and Barry Sternlicht, chairman and CEO of Starwood Capital Group

As the debt ceiling debate nears a critical juncture in Washington D.C., real estate executives in New

York are concerned that absent a final resolution, the fragile recovery will be short circuited by a sudden

spike in interest rates.

Steven Spinola, president of the Real Estate Board of New York, the 12,000-member trade organization,

said the industry’s main concern is the impact a debt ceiling default could have on projects financed

with tax exempt bonds.

“If there is no agreement and our credit rating goes down, what will that do to interest rates?” Spinola

said.

He said many landlords have multi-family apartment buildings financed with 30-year loans that would

face a potential interest rate spike with a credit downgrade. He noted if that happened, lenders might

force those landlords to put more equity into a deal to keep the loan in balance because there is a limit

to how much additional income they could derive from existing rents.

Spinola said he did speak with Sen. Charles Schumer’s office about the debt ceiling debate, but REBNY

has not sent any official policy positions on the debt ceiling fight. Spinola fears that both sides are locked

into such a fierce ideological battle that an organization like REBNY will have limited impact this late in

the game.

“I hope there will be a compromise,” Spinola said.

Schumer’s office did not return calls seeking comment.

Robert Knakal, chairman of commercial real estate brokerage Massey Knakal Realty Services, said he has

reached out to two of out-of-state U.S. senators.

“They are really exasperated with the breakdown in communications,” Knakal said. The two senators,

whom he declined to name, “have said the partisanship is the most significant it has been during the

course of their careers.”

Knakal agreed that the biggest concern is about the impact of higher interest rates, which would put

downward pressure on property values. He said at the end of the day, such a decrease could threaten

the viability of certain projects, as lenders would have to change their assumptions about the ability of

borrowers to pay off existing loans.

Eric Anton, executive managing director at Manhattan-based commercial real estate brokerage Eastern

Consolidated, said the bottom line is that the country spends too much money, and the resulting

downgrade could hurt interest rates over the long-term.

“It’s not about where we are now, it’s where we’re headed,” he said. “There may not be enough money

on the planet to pay interest on this debt.”

On the residential side, there has been little change thus far due to the debt debate, but a downgrade

that affects interest rates could change all that.

“If rates climb, mortgages would be more expensive for buyers, which could slow down sales,” said

Debra Shultz, managing director at Manhattan Mortgage, the largest residential mortgage brokerage in

New York, “and higher rates would also slow down refis.”

Fixed-rate mortgages averaged 4.55 percent nationwide on a 30-year loan, according to data released

today by Freddie Mac.

David Heiden, a principal at W Financial, a Manhattan-based lender that specializes in bridge loans

and mezzanine financing, said that he currently has a half-dozen deals on the table, and nobody has

mentioned the debt ceiling to him as having any impact on their transactions.

Kathy Braddock, co-founder of Manhattan-based residential brokerage Rutenberg Realty, said the

assumption remains that once the screaming stops, there will be a resolution.

“Most people are just passively assuming this will work itself out,” Braddock said. “Interest rates could

tick up. But they are so historically low, borrowing money is still the buy of the century.”

Barry Sternlicht, chairman and CEO of Starwood Capital Group, a Greenwich, Conn.-based real

estate fund, said it it’s unclear what immediate impact that a default would have, but he’s stunned

nevertheless that Washington has allowed the debate to sink to the level it has.

“It’s inconceivable to me that this couldn’t be worked out over time,” he said. “Maybe they shouldn’t

pay the politicians, and that would balance the budget.”