The London-based Children’s Investment Fund inked its first New York City real estate investment this month, providing $250 million in first mortgages for Macklowe Properties’ condominium conversion of the luxury apartment building 737 Park Avenue in Lenox Hill.

The fund, run by low-key hedge fund manager Christopher Hohn, makes investments in a wide range of industries globally, and gives a portion of its profits to children’s charities around the world.

“It is the first direct real estate investment we have made in New York,” Martin Frass-Ehrfeld, a partner with the fund, said. It is not the first in the United States, however. It has made a first mortgage in Washington, D.C.

The firm began looking to place debt or equity in Manhattan real estate about 12 months ago, and lost out on a few opportunities, Frass-Ehrfeld said, before inking this one. “They were some very high-profile things that other people snapped up.” He declined to identify them.

The fund has an advantage over traditional construction lenders — often banks keep the two- or three-year loans on the books — because it has greater flexibility over how it must generate returns.

“If some of the business plan takes longer,” it’s not a problem, he said. “The important thing is the underlying asset is still worth a lot.”

The firm is still looking in New York, but not to purchase alone. “We are not going to buy a building in New York on our own,” he said. “Our main focus is to always partner with experienced local operators.”

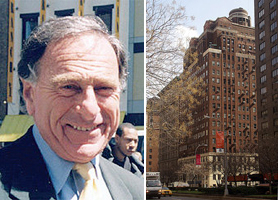

Developer Harry Macklowe’s firm closed on the $253 million purchase of the iconic 737 Park Avenue, at 71st Street, earlier this month.

An affiliate of the Children’s Investment Fund, the Dublin-based Talos Capital Limited, was identified as the lender in city records, filed Aug. 18.

Also, Macklowe wasted no time moving ahead with his $360 million condo conversion, filing an offering plan with the Attorney General, which could allow closings to begin by then end of next year or in 2013.

The Children’s Investment Fund, based in London, provided $250 million in first mortgage loans for the purchase, rehabilitation and condo conversion of the building.

Macklowe and partner CIM Group bought the 108-unit property from the Katz family with the intention to convert the building with 103 apartments and five commercial spaces into luxury condos.

The developer put in about 20 percent, or $21 million of the equity, while CIM Group invested the balance, about $84.8 million.

The largest of the loans, for the acquisition, was $164 million; another $50 million was a building loan; and another $35 million was a project loan, the documents published in city property records last Thursday show.

Macklowe and CIM, through their spokespersons, declined to comment. David Weinberger, a partner at law firm Proskauer Rose who represented the lender, declined to comment.

Also declining to comment was Howard Michaels, chairman and CEO of the Carlton Group, which arranged the financing, and Jonathan Caplan an executive managing director at Jones Lang LaSalle, who led the team that sold the building for the Katz family.