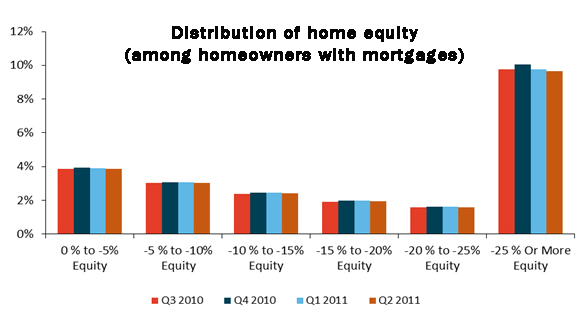

Source: CoreLogic

Nearly a quarter of Americans with residential mortgages are in negative equity and that number is barely improving, according to second-quarter data released today by analytics firm CoreLogic. In the second quarter, 10.9 million homes were worth less than their mortgages, or 22.5 percent of all residential properties with a mortgage. That’s down ever-so-slightly from the 22.7 percent recorded in the first quarter. Another 2.4 million borrowers had less than 5 percent equity, or near-negative equity.

The report notes that the widespread negative equity situations are keeping many Americans from refinancing their mortgages to capitalize on record-low rates. Nearly 75 percent of all underwater borrowers are paying more than the market rate for their mortgage, compared to 53 percent of above-water mortgage borrowers. In all, 28 million Americans pay above market rate for their mortgages. Two-fifths of all Americans who owe 125 percent of their home’s value on their mortgage are paying interest rates above 6 percent.

“High negative equity is holding back refinancing and sales activity and is a major impediment to the housing market recovery. The hardest hit markets have improved over the last year, primarily as a result of foreclosures. But nationally, the level of mortgage debt remains high relative to home prices,” said Mark Fleming, chief economist with CoreLogic.

In the New York-White Plains-Wayne, NJ market — where The Real Deal reported foreclosures were trending upward last week — 120,663 homes, or 10.6 percent of all residential mortgage borrowers, were underwater. At 6.3 percent, or 1.879.940 people, New York state had the lowest share of negative equity borrowers in the country. — Adam Fusfeld