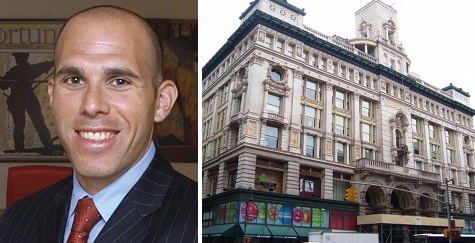

RXR Realty CEO Scott Rechler and 620 Sixth Avenue

RXR Realty will take control of 620 Sixth Avenue from a partnership of Joseph Chetrit, Yair Levy and Charles Dayan in a deal that values the building at about $500 million, the Wall Street Journal reported. The partnership paid $290 million for it in late 2005, and will retain a minority stake.

Douglas Harmon of Eastdil Secured marketed the property for the owners.

The seven-story, 700,000-square-foot, 114-year-old building at 19th Street is 80 percent occupied and home to big-box retailers TJ Maxx and Bed Bath & Beyond. RXR CEO Scott Rechler said the building will generate enough income to cover debt payments beginning next year. Rechler said he was attracted to the building because of its unique appearance and its “Silicon Alley” location — home to the city’s growing tech sector.

The Wall Street Journal said investors’ continued interest in the area — known as Ladies’ Mile for the bevy of department stores that populated the stretch of Sixth Avenue between the Civil War and World War I — and Chelsea as a whole, shows the importance of technology-related firms to the city’s future. Rechler’s RXR has been active of late, buying the Starrett Lehigh Building at 601 West 26th Street earlier this year for $920 million, and acquiring 340 Madison Avenue and 1330 Sixth Avenue and 1166 Sixth Avenue last year. [WSJ]