Trending

NYC unseats London as world’s top city for commercial real estate investment

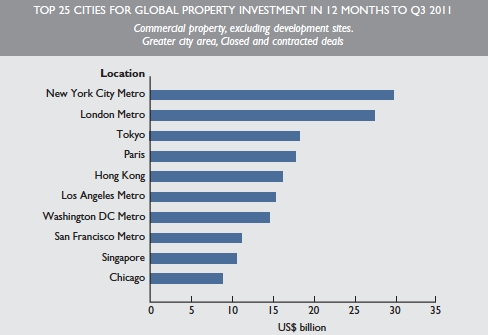

Source: Cushman & WakefieldNew York replaced London as the city attracting the most commercial real estate investment in the world, according to a report released today by Cushman & Wakefield. It’s the first time the city has held the top spot since 2007.

Through the third quarter, the report estimated that investment activity increased 165 percent in New York City. It was first in hotel and multi-family investments, ranked second behind London in office investment at $14.1 billion, and third in retail investment, behind Hong Kong and Germany. London attracted the most non-local investment, as about 50 percent of

investments came from foreigners. Paris and New York City placed second

and third in that measure.

Investments in top 25 cities, which are mostly located in North America and comprise 54 percent of the market, rose 48 percent this year, compared to 41 percent for the entire market. Generally, U.S. cities have shown a modest recovery this year to close the gap with European and Asian cities that experienced recoveries last year. In fact, Chicago was the fastest growing city for commercial investment, barely edging out New York.

The theme of the report though was risk aversion. Ten of the top 25 investment cities were also among the 25 lowest yielding cities in the world. The average yield for the top 25 cities was 6.3 percent, compared to the global average of 7.4 percent.

“The global economic and geopolitical headwinds we face are resulting in investor behavior that reinforces the apparent stability offered by core investments in the top five ‘mega’ cities,” said Greg Vorwaller, global head of capital markets at Cushman & Wakefield. — Adam Fusfeld