Source: Prudential Douglas Elliman

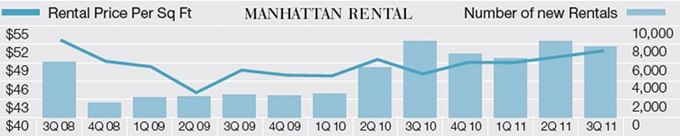

In stark contrast from the various economic indicators surrounding it, the

Manhattan rental market showed remarkable stability and strength in the third

quarter. The price of an average Manhattan rental unit increased about 7 percent

from the prior year quarter and remained consistent with the impressive levels

achieved in the second quarter, according to market reports released today by

residential brokerages Prudential Douglas Elliman and Citi Habitats.

“I used to see the rental market as a leading indicator of changing economic

conditions because of how nimble it is,” said Jonathan Miller, CEO of appraisal firm

Miller Samuel who prepared Elliman’s report. “But here the economy is struggling —

or at best, is flat — and conditions are tight in the rental market.”

That’s because the economy has been so volatile that people are putting off their

purchasing decision and instead choosing to rent. Even those who are inclined to

buy, Miller noted, are encountering such strict mortgage underwriting standards

that they’re forced to reconsider.

To wit, Elliman’s report shows rental activity during the typically active summer

months slipped 6.9 percent from the same period a year ago to just 7,998

transactions, and 6.7 percent from the second quarter. Combined with the rising

rents, the data suggests many renters are staying put and delaying

decisions to move to another rental or buy, Miller speculated.

Factoring in concessions, the average monthly rent for a Manhattan apartment

increased 6.9 percent from the third quarter of 2010 to $3,491, Elliman data shows. The rental price per square foot skyrocketed 13.6 percent in that

timeframe to $50.60, according to the report.

In addition to the prospective buyers sitting on the sidelines, rental demand is so

strong, Citi Habitats President Gary Malin said, because of the extremely diverse and relatively resilient local

job market. According to the most recent data from the New York State Department of Labor, the city’s unemployment rate is 8.7 percent compared to 9.1 percent nationwide.

As a result the citywide vacancy rate was just 0.93 percent during the third

quarter, according to Citi Habitats’ report, which is based on transactions brokered by the firm. The report shows the average Manhattan

apartment rented for $3,346 a month during the quarter, 7.3 percent above the

going rate during the third quarter of 2010.

Both reports suggest that renters seeking bargains would be wise to look uptown.

Citi Habitats found the Upper West Side to have the second highest vacancy rate of

all neighborhoods below Harlem at 1.14 percent and the Upper East Side to have the

cheapest rents, for most unit sizes.

Elliman’s report found the average price for an uptown rental to be just $2,216 per

month, or $26.56 per square foot, compared to $3,842 and $53.07, respectively,

for the pricey downtown region. But bargain hunters better act fast: the report

indicates prices are rising faster uptown than anywhere else, gaining 17.4 percent

from last year and 25.1 percent from last quarter (though the sample size was

significantly smaller because their was less activity in the area).

While seasonal factors are sure to offer some relief to fourth-quarter renters, both

Miller and Malin expect landlords to maintain the upper hand for the foreseeable

future. Miller said that even though the higher end of the market may be

approaching the point where it makes more sense to buy, rents still have room to

rise before the market reaches that point, and even then the shift will be gradual.

“The rental market is notorious for reacting quickly,” Malin added, “and certain

people certainly will buy if it makes more sense. But it’s not going to be a massive,

demand-shifting wave, because uncertainty still rules the marketplace.”