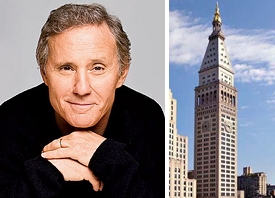

Ian Schrager and the Clock Tower at 5 Madison AvenueHotelier Ian Schrager appears to be returning to the Clock Tower at 5 Madison Avenue.

According to Real Estate Weekly, Marriott International purchased the 220,000-square-foot office tower overlooking Madison Square Park from Africa Israel and plans to turn it into an Edition Hotel, the boutique hotel line it launched with Schrager. Africa Israel was previously reported to have sold the tower for $165 million, but the buyer was only identified as “a credit-worthy” one.

Though Marriott typically does not own its real estate, the hotel operator wants to buy property for its struggling Edition line, which it hopes will compete with Starwood’s W Hotel brand, to help get it off the ground. Marriott had planned to open 100 such hotels within ten years of the 2007 launch, according to the Wall Street Journal, but just two have opened thus far and one, in Hawaii, dropped the Edition moniker. Marriott has $400 million plans to open Editions in Miami Beach and London.

But both the Journal and Real Estate Weekly note that there will be challenges to building a successful hotel in the Clock Tower. A hotel conversion could reduce the amount of usable square feet to 150,000, Real Estate Weekly said, while the Journal noted that there was limited space for the lobby, restaurant and other amenities.

Schrager had partnered with Aby Rosen to buy a controlling stake in the building from SL Green, but turned around and sold it to Africa Israel in 2007 for $200 million. Africa Israel was near a deal with Tommy Hilfiger for the building, but the designer backed out. [WSJ] and [REW]