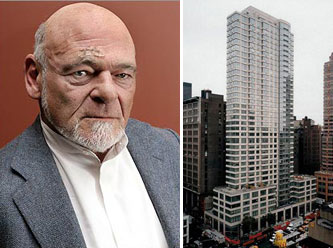

Sam Zell’s Equity Residential has emerged as the leading bidder in a race to buy 53 percent of rival Archstone, offering more than $2.5 billion in cash for the stake, currently held by Bank of America and Barclays, the Wall Street Journal reported. The rest of the company, a real estate investment trust, is owned by the bankruptcy estate of Lehman Brothers Holdings.

The proposed sale to Equity Residential would value Archstone at about $16 billion, the Journal said. If sold as a whole company, Archstone currently could be worth as much as $18 billion.

Real estate giants the Blackstone Group, Brookfield Asset Management, Equity Residential and AvalonBay Communities have all submitted bids for Archstone in recent months, it was previously reported.

If Equity Residential wins the bidding, it could mean a battle over control of Archstone, the Journal noted. Barclays and the estate of Lehman Brothers Holdings had been arguing over the REIT. Barclays was pushing to sell it or its assets privately whereas Lehman favored a longer-term approach: taking the company public in what would be the largest real estate initial public offering ever. [WSJ]